Introduction

When your roof starts leaking or showing its age, the first question most homeowners ask isn’t just “how much will it cost?” but also “is replacing the roof on a house a capital improvement?”

It’s a smart question — because how you classify that roof replacement can make a big difference at tax time. Capital improvements may add value to your property and impact your tax basis, while ordinary repairs generally do not.

In this guide, we’ll break down what qualifies as a capital improvement, when a roof replacement fits the definition, how the IRS views it, and what documentation you need to keep.

Read too: Hail Damage Roof Repair: Essential Guide to Restoring Your Home’s Protection

What Is a Capital Improvement?

According to the IRS, a capital improvement is a permanent structural change or restoration that adds value to your property, prolongs its useful life, or adapts it for a new use.

That means capital improvements go beyond simple maintenance. They typically:

- Extend the life of your home

- Increase resale value

- Become part of the property itself (not easily removable)

Examples include:

- Installing a new HVAC system

- Adding a deck or garage

- Replacing all windows

- Building an addition

By contrast, routine repairs and maintenance, such as patching a few shingles or fixing a leak, are not considered capital improvements because they only restore functionality, not add long-term value.

👉 Source: Wikipedia: Home improvement

Is Replacing The Roof On A House A Capital Improvement?

The answer: Yes — replacing an entire roof is generally considered a capital improvement.

Here’s why:

- It’s a permanent structural enhancement to your property.

- It extends the home’s lifespan.

- It increases market value and curb appeal.

However, roof repairs (like fixing leaks or replacing a few shingles) do not qualify.

Let’s break it down:

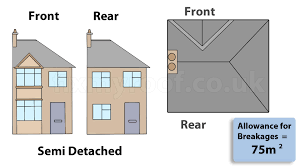

| Type of Work | Capital Improvement? | Reason |

|---|---|---|

| Full roof replacement | ✅ Yes | Adds value, extends life |

| Replacing all shingles | ✅ Usually yes | Structural and lasting |

| Repairing a small section | ❌ No | Maintenance only |

| Patching a leak | ❌ No | Temporary fix |

| Upgrading to metal roof | ✅ Yes | Long-term durability |

So, if you completely replace your old roof with a new one — especially using better materials — the IRS typically classifies it as a capital improvement.

IRS Guidelines: What Makes It Official

The IRS Publication 523 (“Selling Your Home”) specifically states that improvements adding to your home’s value, extending its life, or adapting it to new uses qualify as capital improvements.

That means a roof replacement usually passes the IRS test — it improves longevity and functionality.

However, keep these criteria in mind:

- The improvement must be permanent.

- It must be attached to the property.

- It must add measurable value or longevity.

You cannot claim roof maintenance as a capital improvement since it’s not structural or permanent.

Capital Improvement vs. Repair: Key Differences

Many homeowners confuse improvements with repairs — but for tax and accounting purposes, they’re treated very differently.

| Category | Capital Improvement | Repair/Maintenance |

|---|---|---|

| Purpose | Adds value or extends life | Restores function |

| Duration | Long-term (years) | Short-term fix |

| Tax Treatment | Added to property’s cost basis | Not deductible |

| Example | Replacing entire roof | Fixing a small leak |

Pro tip:

If your contractor installs new materials (like switching from asphalt to metal or tile), it’s clearly a capital improvement since you’re upgrading your home’s value and durability.

How Capital Improvements Affect Taxes

When you sell your home, the IRS allows you to add capital improvements to your property’s cost basis — effectively reducing your taxable gain.

Here’s how it works:

Example:

- You bought your house for $300,000

- You replaced the roof for $20,000 (capital improvement)

- You sell it for $400,000

Your adjusted cost basis becomes $320,000, meaning your taxable profit is only $80,000 instead of $100,000.

This can significantly lower your capital gains tax liability.

When Roof Replacement Is Not a Capital Improvement

Not every roof project qualifies. The following scenarios typically do not count as capital improvements:

- Fixing leaks or holes

- Replacing a few damaged shingles

- Temporary patching or sealing

- Emergency repairs after a storm

Why? Because these are repairs, not enhancements — they restore the roof’s condition but don’t improve or extend its life.

However, if storm damage leads you to replace the entire roof, that full replacement does qualify as a capital improvement.

Energy-Efficient Roofs and Tax Credits

If you replace your roof using energy-efficient materials, you may qualify for federal energy tax credits under the Inflation Reduction Act (extended through 2032).

For example:

- Cool roofs, which reflect sunlight, can qualify for credits.

- Metal roofs with Energy Star ratings may also be eligible.

The IRS allows a tax credit of up to 30% of certain qualifying improvements. Always verify eligibility before filing, as credits vary yearly.

Step-by-Step: How To Document a Roof Replacement for Tax Purposes

To ensure your roof replacement is properly recorded as a capital improvement:

- Save all receipts and invoices — labor, materials, permits, and disposal fees.

- Note the date of completion — improvements count in the year they’re finished.

- Keep photos before and after — proof of value addition.

- Store contractor contracts and warranties — they establish the permanence of the work.

- Attach it to your property records — include when calculating your adjusted cost basis during sale.

💡 Pro Tip: Keep these records for as long as you own the home plus three years after selling.

Case Study: Homeowner Example

Scenario:

Maria, a homeowner in Texas, replaced her 18-year-old asphalt roof with a new standing-seam metal roof for $22,000.

- The new roof extended the lifespan from 20 to 50 years.

- It improved energy efficiency and home value by $18,000.

- She saved all documentation.

Result:

When Maria sold her home, she added the roof replacement to her cost basis and reduced her taxable gain by $22,000 — saving over $4,400 in capital gains taxes.

Expert Insight

According to Tax Foundation data, U.S. homeowners spend over $400 billion annually on home improvements, with roof replacements ranking among the top five most valuable upgrades.

“Roof replacements almost always qualify as capital improvements because they add lasting structural value to a property,” says CPA Karen Jacobs, a real estate tax advisor based in Florida.

Her advice:

“Document everything, and don’t mix repair invoices with improvement invoices. The IRS loves clarity.”

FAQ Section

1. Is replacing the roof on a house a capital improvement?

Yes. A full roof replacement qualifies as a capital improvement because it permanently enhances your property’s value and longevity.

2. Are roof repairs considered capital improvements?

No. Routine repairs that restore functionality (like fixing a leak) do not qualify — they’re maintenance, not improvement.

3. Can I claim my roof replacement on my taxes?

Not immediately. You can’t deduct it annually, but it adds to your home’s cost basis, reducing potential capital gains tax when you sell.

4. What documentation do I need for proof?

Receipts, contracts, before-and-after photos, and warranty information — keep them with your home’s records for future tax filings.

5. Do energy-efficient roofs qualify for tax credits?

Yes, some do. Energy Star-certified roofing materials can earn up to a 30% tax credit, depending on IRS program eligibility.

6. How do I prove it’s a capital improvement to the IRS?

By demonstrating permanence, added value, and lifespan extension through receipts, permits, and warranties.

Conclusion

So, is replacing the roof on a house a capital improvement?

In most cases — absolutely yes. A full roof replacement improves value, longevity, and efficiency, which the IRS recognizes as a capital enhancement.

By keeping good records, you can potentially save thousands in capital gains taxes when you sell your home.

Your roof isn’t just protection — it’s an investment in your property’s future.

If you found this guide helpful, share it with fellow homeowners — they’ll thank you when tax season rolls around!

Leave a Reply