Looking for My Roof Repossessed Houses For Sale in Avondale, De Tyger, or Goodwood? You’re not alone. Many South African homebuyers are turning to repossessed properties to find affordable homes in sought-after suburbs around Cape Town. Whether you’re a first-time buyer or a seasoned investor, buying through MyRoof can offer excellent value — if you know what to look for.

In this guide, we’ll explore everything you need to know about finding, evaluating, and purchasing repossessed houses for sale in Avondale, De Tyger, and Goodwood through MyRoof. From understanding what “repossessed” means to practical buying tips, this article will walk you through each step clearly and confidently.

Read too: How Long Do Standing Seam Metal Roofs Last? A Comprehensive Guide to Durability and Longevity

What Are Repossessed Houses and How Do They Work?

Repossessed houses (also known as bank repossessed properties) are homes taken back by a bank when the previous owner defaults on their mortgage payments. Instead of leaving the property vacant, banks list these homes for sale — often below market value — to recover their losses.

According to the South African Reserve Bank, property repossessions have increased in recent years due to economic pressure and rising living costs. This has created a growing market for budget-conscious buyers and investors looking for discounted homes in areas like Avondale, De Tyger, and Goodwood.

Here’s how the process generally works:

- The bank reclaims ownership of a property after loan default.

- The home is listed on a verified platform such as MyRoof.co.za.

- Buyers can place offers, view details, and even arrange inspections.

- Once accepted, the property is transferred through standard conveyancing processes.

💡 Fun Fact: According to Wikipedia, property repossession is a global practice that helps financial institutions recover debts while giving buyers access to affordable housing options.

Why Buy Through MyRoof?

MyRoof.co.za is one of South Africa’s most reputable property auction and listing platforms. Here’s why it’s a great choice for purchasing repossessed houses:

| Feature | MyRoof Advantage |

|---|---|

| Verified Bank Listings | Direct partnerships with ABSA, Standard Bank, FNB, and Nedbank |

| Transparent Pricing | View current bids and property values easily |

| Virtual Tours | Many listings include 3D or photo tours for remote viewing |

| Secure Offers | All offers go through the bank for approval |

With MyRoof, you can search for repossessed houses for sale in Avondale, De Tyger, and Goodwood from the comfort of your home — no agents or middlemen needed.

Top Areas: Avondale, De Tyger, and Goodwood

1. Avondale – Suburban Charm Meets Affordability

Avondale, located near Parow and Bellville, is a quiet residential suburb with easy access to major highways and shopping centers.

Average Property Price: R1.2 – R2.5 million

Best For: First-time buyers, families, and professionals

Pros:

- Close to top schools and parks

- Affordable compared to neighboring areas

- Strong rental market

Cons:

- Limited availability of new builds

- Competition for repossessed listings can be high

2. De Tyger – Prestigious and Convenient

De Tyger is known for its peaceful streets, excellent security, and proximity to major business hubs. It’s a preferred suburb for those wanting suburban living with urban convenience.

Average Property Price: R2.5 – R4 million

Best For: Professionals and investors

Pros:

- Central location (10–15 minutes to Cape Town CBD)

- Well-maintained properties

- Strong resale value

Cons:

- Higher prices for prime listings

- Limited stock in repossessed categories

3. Goodwood – Growing Investment Hotspot

Goodwood has become a real estate favorite thanks to its vibrant mix of residential and commercial properties.

Average Property Price: R1.3 – R3 million

Best For: Investors and renovators

Pros:

- Great rental yields

- Public transport access (train & MyCiTi routes)

- Near schools and shopping centers

Cons:

- Older properties may require renovations

- Demand often outpaces supply

How to Find Repossessed Houses on MyRoof

Here’s a step-by-step guide to finding My Roof Repossessed Houses For Sale Avondale De Tyger Goodwood:

- Visit MyRoof.co.za

Navigate to the homepage and select “Repossessed Properties.” - Filter by Location

Enter Avondale, De Tyger, or Goodwood in the location filter. - Set Your Budget Range

Use the slider to select your desired price range (e.g., R800,000 – R2 million). - View Property Details

Check images, floor plans, and title deed info. Some listings even include valuation reports. - Place Your Offer

Click “Place Bid” or “Make Offer.” MyRoof will send your offer to the bank for approval. - Follow Up and Finalize

Once approved, proceed with conveyancing. MyRoof can recommend legal professionals to help you complete the process smoothly.

Benefits of Buying Repossessed Homes

Buying through My Roof offers several key advantages compared to traditional sales:

| Benefit | Description |

|---|---|

| Lower Prices | Often 10–40% below market value |

| No Transfer Duty | Some bank sales include reduced fees |

| Fast Approval | Streamlined bank-to-buyer process |

| Investment Potential | Great ROI in developing suburbs |

However, it’s important to inspect the property thoroughly and review legal documents before committing.

Common Mistakes to Avoid

Even experienced buyers can make errors when purchasing repossessed properties. Avoid these pitfalls:

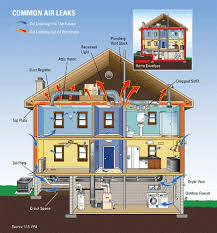

- Skipping inspections: Always check property condition before bidding.

- Ignoring legal fees: Budget for attorney and registration costs.

- Overbidding: Stay within market value to avoid financial strain.

- Assuming move-in readiness: Some repossessed homes may need repairs.

Expert Insight

According to Property24 market analyst Lerato Mthembu, “Repossessed homes in Cape Town’s northern suburbs, particularly in Goodwood and De Tyger, offer returns between 12% and 20% annually when properly renovated and rented out.”

This highlights why more South Africans are exploring repossessed listings as a viable investment strategy — especially via platforms like MyRoof, which ensures transparency and security.

Frequently Asked Questions (FAQ)

1. What is MyRoof?

MyRoof.co.za is a South African online property platform that lists repossessed and private homes for sale directly from banks and owners.

2. Are repossessed homes cheaper than regular listings?

Yes. They are often priced 10–30% below market value because banks prioritize quick sales.

3. Do I need a real estate agent to buy from MyRoof?

No. You can make offers directly through the platform, although you can use an agent for guidance if desired.

4. Can I view the property before buying?

Yes, many listings allow scheduled viewings. Always verify availability with MyRoof or the bank representative.

5. What are the hidden costs when buying repossessed homes?

Possible costs include legal fees, repairs, rates clearance, and arrears that may need settlement.

6. Are repossessed homes safe to buy?

Absolutely — especially when listed through verified channels like MyRoof, which ensures authenticity and legal compliance.

Conclusion

Buying a My Roof Repossessed House in Avondale, De Tyger, or Goodwood can be one of the smartest moves you make as a property investor or homeowner. With transparent listings, secure transactions, and potential savings of up to 30%, MyRoof empowers you to find affordable homes in prime Cape Town suburbs.

Remember:

- Always research the property and area.

- Compare listings before making an offer.

- Seek professional advice if needed.

By following these steps, you’ll be well on your way to owning a quality home at a fraction of the market price.

Leave a Reply