Investing in solar energy not only benefits the environment but can also provide financial incentives for homeowners, including tax credits. The Federal Solar Tax Credit for roof replacement is a tax incentive designed to encourage individuals to adopt renewable energy sources and integrate solar energy into their homes. But how does it apply to roof replacements? Can replacing or upgrading your roof make you eligible for the Federal Solar Tax Credit? In this article, we’ll explore how the tax credit works, who can qualify, and the specifics you need to know about using it for roof replacement.

What Is the Federal Solar Tax Credit?

The Federal Solar Tax Credit, also known as the Investment Tax Credit (ITC), was established to encourage the adoption of solar energy systems. It allows homeowners to deduct a portion of their solar installation costs from their federal taxes. The current ITC allows eligible homeowners to claim a credit of up to 30% of the total cost of installing solar panels, as of recent policy extensions. This tax credit can lead to significant savings, especially for large installations.

Read too: Is It Reasonable to Ask the Seller to Replace the Roof?

Can the Federal Solar Tax Credit Be Used for Roof Replacement?

The short answer is yes—in certain cases. If the roof replacement is necessary for the installation or function of solar panels, it may qualify for the Federal Solar Tax Credit. However, it’s essential to understand the specific circumstances under which a roof replacement or upgrade can be considered eligible for the ITC. Not all roof replacements will qualify, so let’s break down the requirements.

Eligibility Requirements for the Federal Solar Tax Credit for Roof Replacement

To take advantage of the Federal Solar Tax Credit for roof replacement, your project needs to meet specific criteria:

- Direct Association with Solar Installation

- The tax credit applies to costs that are essential to the solar installation. If a roof upgrade or replacement is essential to supporting or accommodating the solar panels, then this expense may be eligible.

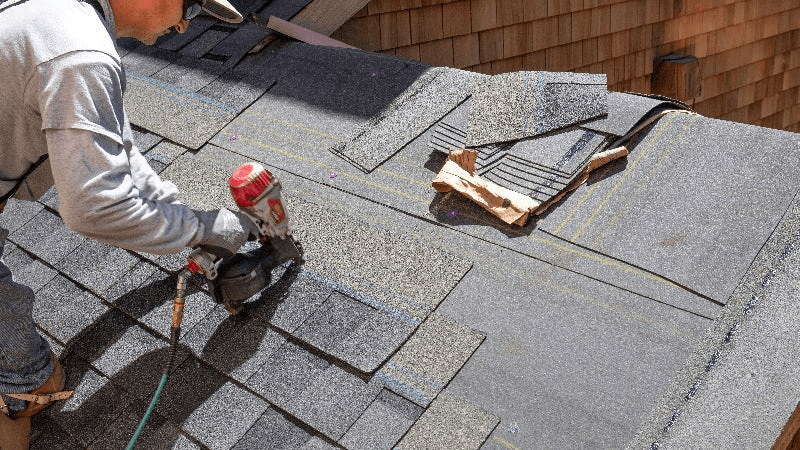

- For example, if you need to replace or reinforce roof tiles, shingles, or materials to ensure the solar panels are securely mounted, that portion of the roof upgrade may qualify.

- Solar-Ready Roofing Materials

- If you opt for solar-ready roofing materials, like solar shingles or other roofing components that integrate with solar panels, those costs are also likely to be covered under the Federal Solar Tax Credit.

- Solar shingles, specifically, are designed to act as both roof protection and energy generators, making them doubly eligible for the tax credit since they replace traditional roofing materials with energy-producing technology.

- Residential Ownership Requirement

- The ITC is available only for homeowners, meaning that rented properties may not qualify for the tax credit under the same terms. To claim the Federal Solar Tax Credit, you need to own the home and the solar system installed on it.

- There are also some restrictions for multi-family units and vacation homes, so verifying eligibility based on property ownership and usage type is recommended.

- Timing of Installation

- For the roof replacement to be eligible, it generally needs to be completed at the same time as or shortly before the solar panel installation. If the roof upgrade was done independently and significantly before solar installation, it might not qualify.

Claiming the Federal Solar Tax Credit for Roof Replacement

The process of claiming the Federal Solar Tax Credit for roof replacement involves filing IRS Form 5695, “Residential Energy Credits,” as part of your federal tax return. Here’s how you can ensure a smooth process:

- Gather Documentation

- Keep detailed receipts and contracts related to both the roof replacement and the solar installation. Documentation should clearly indicate the costs associated with the solar-related roof upgrades.

- Itemize Qualified Costs

- When claiming the tax credit, you must specify which costs were directly related to the solar panel installation. Expenses that were incurred solely for solar system support or enhancement (like solar-ready materials) should be itemized.

- Work with a Tax Professional

- Because tax laws are complex and often subject to changes, consulting with a tax professional is advisable. They can guide you on eligibility, itemization, and maximizing your benefits through the Federal Solar Tax Credit.

Benefits of the Federal Solar Tax Credit for Roof Replacement

Choosing to integrate solar panels during a roof replacement offers several advantages beyond the tax credit itself. Here are some benefits:

- Long-Term Energy Savings

- With solar panels, homeowners can reduce their reliance on traditional energy sources, leading to lower utility bills and long-term energy savings. Over the life of the panels (typically 25-30 years), the savings can be substantial.

- Increased Property Value

- Homes with solar energy systems often have higher property values, as energy-efficient features appeal to eco-conscious buyers. This value can also be enhanced with a new or upgraded roof.

- Environmental Impact

- Adopting solar power reduces your home’s carbon footprint, helping to lower emissions and reduce reliance on fossil fuels.

- Additional Local Incentives

- Some states and municipalities offer additional incentives or rebates for solar installations. Checking your local options can provide further savings on top of the Federal Solar Tax Credit.

Challenges and Considerations

While the Federal Solar Tax Credit for roof replacement is beneficial, there are some potential challenges to keep in mind:

- Not All Roof Replacements Qualify

- If the roof replacement is unrelated to the solar panel installation or not necessary for it, it may not be covered by the ITC. Only the portions of the replacement directly supporting solar are eligible.

- Cost of Solar Shingles or Specialty Roofs

- While solar-ready materials like solar shingles are eligible for the tax credit, they come at a higher cost than traditional shingles. Balancing your budget and potential energy savings is essential before committing to high-cost materials.

- Expiration Dates for Tax Credit

- Although the ITC has been extended, it’s wise to verify the latest expiration dates or potential phase-outs. Federal incentives may be subject to change, impacting the percentage of the tax credit available in future years.

- Complexity of Filing Taxes

- The process of applying for the Federal Solar Tax Credit with a roof replacement can involve specific itemization and documentation, making it more complex than a typical tax return.

Conclusion

Combining roof replacement with a solar installation is an excellent way to capitalize on tax credits and enhance energy efficiency. However, it’s essential to weigh your options carefully and ensure your project aligns with ITC requirements.

If your roof is in need of replacement, it may be ideal timing to install solar panels and take advantage of the Federal Solar Tax Credit. The initial investment is higher, but the long-term savings and benefits are well worth it for homeowners looking to increase their home’s efficiency and value.

Leave a Reply