When it comes to replacing a roof, financial planning is crucial. Roofing is a significant investment, and understanding your options can help ensure your decision aligns with your budget and long-term financial goals. Two common financial approaches homeowners often encounter are the roof payment schedule and the roof replacement cost buyback. In this article, we’ll dive into Roof Payment Schedule Vs Roof Replacement Cost Buyback, exploring each option’s details, pros and cons, and how to decide which might work best for your situation.

Roof Payment Schedule Vs Roof Replacement Cost Buyback: Key Differences Explained

Roof payment schedules and roof replacement cost buyback options are different financial strategies that provide flexibility for homeowners. Let’s break down these concepts in greater detail to clarify the distinctions and benefits of each.

What Is a Roof Payment Schedule?

A roof payment schedule is a financing plan that allows you to pay for a new roof through a series of scheduled payments rather than a lump sum. Many roofing companies offer payment schedules to make roof replacement more accessible by dividing the total cost over months or even years.

Read too: How To Replace A Mobile Home Roof: Step-by-Step Guide for Homeowners

How Roof Payment Schedules Work

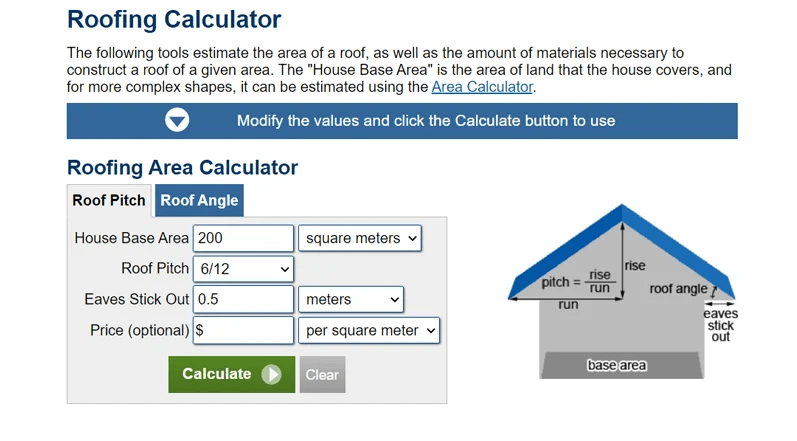

Typically, roof payment schedules are set up as installment plans. After agreeing on a total cost, the contractor and homeowner establish a payment timeline. Here’s how a typical payment schedule might look:

- Deposit: This usually ranges from 10-30% of the total cost, paid upfront before work begins.

- Milestone Payments: Payments are made at various stages of the roofing project, such as after materials are delivered or once certain parts of the work are completed.

- Final Payment: The remaining balance is paid upon project completion and inspection.

Some roofing companies may offer in-house financing, while others work with third-party financing partners to provide payment options for customers. Interest rates and terms vary depending on the financing provider and the homeowner’s creditworthiness.

Pros and Cons of Roof Payment Schedules

Pros:

- Reduced Upfront Cost: Homeowners avoid paying the total amount upfront, which can make roofing projects more affordable.

- Flexible Terms: Payment schedules can often be tailored to a homeowner’s budget and cash flow.

- Immediate Access: Financing enables homeowners to start essential roofing work without delay.

Cons:

- Interest and Fees: Financing plans may come with interest or additional fees that increase the overall cost of the project.

- Debt Obligations: Payment schedules may create a long-term debt commitment, which could impact credit or other financial plans.

- Credit-Based Approval: Not all homeowners may qualify for a financing plan, as it often depends on credit history and financial standing.

What Is Roof Replacement Cost Buyback?

Roof replacement cost buyback is an insurance-related option, often provided as part of certain home warranty or roof insurance policies. This option allows homeowners to receive a “buyback” or reimbursement on their roof replacement costs under specific circumstances. Cost buyback arrangements are most often structured through insurance policies that cover a portion of replacement costs after a roof experiences qualifying damage or reaches the end of its warranty period.

How Roof Replacement Cost Buyback Works

Typically, roof replacement cost buyback functions as a form of coverage that allows homeowners to be reimbursed after roof replacement. This setup generally includes the following elements:

- Eligibility: A qualifying condition must be met for buyback to be offered. For example, the roof might need to sustain storm damage, or a warranty period must have expired.

- Claim Filing: Homeowners file a claim, and, after an inspection, the insurance company evaluates the condition and eligibility.

- Reimbursement: Depending on the policy terms, the homeowner receives a payout or buyback amount toward the roof replacement cost, which can help significantly reduce out-of-pocket expenses.

Pros and Cons of Roof Replacement Cost Buyback

Pros:

- Cost Savings: Buyback options can cover a portion of replacement costs, reducing the homeowner’s financial burden.

- Peace of Mind: Homeowners with buyback policies may feel more secure knowing they have coverage for future roof replacement.

- Extended Roof Protection: Buyback arrangements are typically part of extended warranties or special insurance, providing an added layer of protection.

Cons:

- Eligibility Requirements: Not all roofing conditions qualify for buyback; it often depends on specific terms.

- Deductibles and Limitations: Policies may include deductibles or caps on coverage amounts, which could limit the extent of reimbursement.

- Insurance Premiums: Homeowners may face increased premiums for policies with buyback options.

Roof Payment Schedule Vs Roof Replacement Cost Buyback: Which Option is Better?

Choosing between a roof payment schedule and a replacement cost buyback depends largely on your financial situation, roofing needs, and long-term plans for your home.

- If You Need Immediate Work Without Upfront Funds

A roof payment schedule might be more beneficial if you need the roof replaced immediately but do not have sufficient cash on hand. With a manageable payment plan, you can have the work done promptly without waiting to save up the entire cost. - If You Have a Qualifying Policy

A roof replacement cost buyback might be an ideal option if you already have a qualifying policy and your roof requires replacement due to storm damage or similar covered circumstances. However, remember that buyback policies come with eligibility criteria, and payouts may not cover the full cost. - Long-Term Financial Planning

For homeowners planning for future roof replacement, investing in a buyback policy may provide peace of mind by ensuring they receive some reimbursement when the time comes. - Considering Interest Costs vs. Premiums

If you decide on a roof payment schedule, be aware that interest costs could make the overall expense higher. Conversely, roof replacement buyback options may require higher premiums over time, but these policies can offer cost protection without accruing interest.

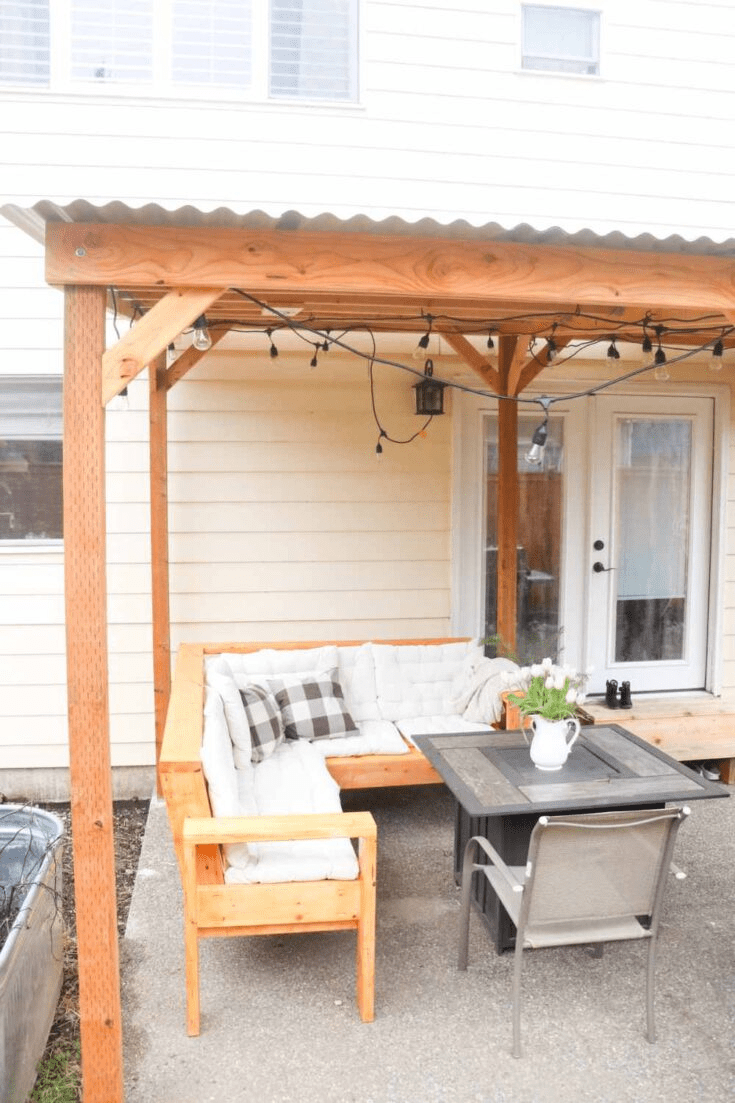

Additional Tips for Managing Roof Replacement Costs

Replacing a roof is an investment, and understanding your financial options can make the process more manageable. Here are some strategies to keep in mind:

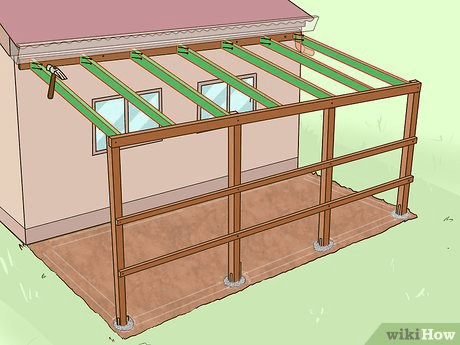

1. Research Roofing Contractors

Get quotes from multiple contractors to compare prices and find those who offer financing options or accept insurance.

2. Assess Warranty Options

Some roofing companies offer warranties that include repair or replacement options. These warranties can be valuable, especially in regions prone to severe weather.

3. Consider Other Financing Sources

Personal loans or home equity lines of credit (HELOCs) may also be options, especially for those who prefer not to enter into roof-specific payment plans.

4. Plan for Maintenance

Regular maintenance can extend the life of your roof, helping you avoid early replacement and unplanned expenses.

Frequently Asked Questions (FAQ)

Q1: Can I use both a roof payment schedule and a buyback policy?

Yes, some homeowners may choose to finance their roof replacement through a payment schedule while also holding a buyback policy for added protection.

Q2: Are roof replacement cost buybacks available for older roofs?

Eligibility for a buyback depends on the policy. Some insurance or warranty plans have specific age limits or condition requirements.

Q3: What’s the average cost of a roof replacement?

Roof replacement costs vary widely, with most projects costing between $5,000 and $15,000, depending on materials, labor, and roof size.

Conclusion

Making informed financial decisions for roof replacement can help you manage costs effectively. Roof payment schedules allow for manageable payments over time, ideal for homeowners needing immediate replacement without upfront funds. Roof replacement cost buyback offers a potential reimbursement route, particularly for those with qualifying insurance policies or warranties.

Understanding the differences between these two options and evaluating your circumstances can make the decision-making process simpler. Whether you choose a payment schedule for convenience or opt for a cost buyback policy for future savings, it’s essential to ensure you’re protecting your home and budget in the long run.

Leave a Reply