Flat roofs are a popular choice for many homes, offering a sleek and modern design. However, they can also come with unique challenges, particularly when it comes to leaks. If you’re dealing with a leaking flat roof, you might be wondering, “Can I claim on house insurance for leaking flat roof issues?” This article dives deep into the topic, providing the essential details you need to understand your insurance policy and take the right steps to address the damage.

Understanding Flat Roofs and Their Challenges

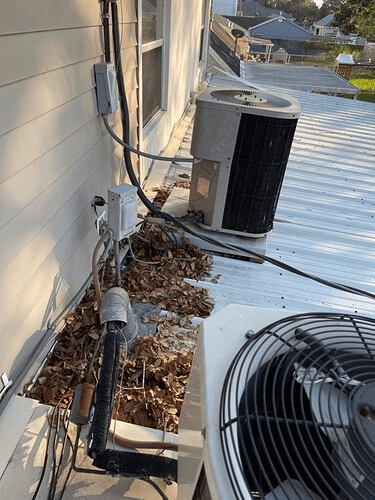

Flat roofs, unlike their pitched counterparts, are more susceptible to water pooling and damage over time. While they are not entirely flat, the slight slope may not always be sufficient for proper water drainage. Over time, weather elements, aging materials, or poor maintenance can lead to leaks, which may cause damage to your home’s interior.

Read too: How Long Do Standing Seam Metal Roofs Last? A Comprehensive Guide to Durability and Longevity

Whether or not you can claim these issues on your home insurance depends on several factors, including the cause of the leak, your insurance policy, and how the damage was reported.

Can I Claim On House Insurance For Leaking Flat Roof?

The short answer is: it depends. Insurance claims for flat roof leaks are typically subject to specific terms and conditions outlined in your home insurance policy. Here’s a breakdown of what usually determines your eligibility:

1. Cause of the Leak

Insurance policies often cover sudden and unexpected damage, such as that caused by storms, heavy rain, or falling debris. If your flat roof leak resulted from one of these events, your insurer might approve the claim.

However, leaks caused by wear and tear, lack of maintenance, or aging materials are often excluded from coverage. Insurers expect homeowners to maintain their property and address minor issues before they escalate.

2. Coverage Type

Your home insurance policy typically includes one or more of the following:

- Buildings Insurance: Covers structural elements, including roofs, walls, and foundations.

- Contents Insurance: Covers personal belongings and furniture damaged by the leak.

Review your policy to determine whether your insurance includes these protections and how they apply to flat roof leaks.

3. Evidence and Documentation

To file a successful claim, you’ll need to provide evidence of the damage and its cause. Photos, repair invoices, and a professional assessment can strengthen your claim.

4. Policy Exclusions

Many policies exclude damage caused by poor maintenance or pre-existing issues. If your roof was already showing signs of damage or disrepair, your claim might be denied.

Steps to Take Before Filing a Claim

If you suspect a leak in your flat roof, follow these steps to ensure you handle the situation properly:

1. Inspect the Damage

Carefully assess the extent of the damage. Is it limited to one area, or has water seeped into multiple parts of your home? Take photos or videos of the damage for documentation purposes.

2. Determine the Cause

Identifying the cause of the leak is essential. If a storm or severe weather caused the damage, document the event and gather evidence, such as weather reports or photos of nearby damage.

3. Review Your Insurance Policy

Examine your home insurance policy for details about roof coverage. Look for terms related to flat roofs, leaks, and exclusions to understand your coverage.

4. Contact Your Insurer

Reach out to your insurance provider to report the damage. Be prepared to share the details of the incident, including the date it occurred, the cause, and the extent of the damage.

5. Hire a Professional

A professional roofer or contractor can assess the damage and provide an estimate for repairs. Their evaluation can serve as critical evidence for your insurance claim.

Common Scenarios for Flat Roof Insurance Claims

1. Storm Damage

If a heavy storm causes branches to fall on your roof, resulting in leaks, this is typically covered by insurance. Document the event and report the damage promptly.

2. Snow and Ice Accumulation

In colder climates, snow and ice can accumulate on flat roofs, leading to leaks when they melt. If this happens suddenly and causes damage, your claim is likely to be approved.

3. Poor Maintenance

Leaks resulting from blocked drains, moss growth, or failing to fix visible damage are usually not covered. Insurers expect homeowners to perform regular maintenance to prevent avoidable issues.

4. Gradual Deterioration

Flat roofs have a lifespan, usually between 10-20 years. If your roof has deteriorated over time and started leaking, insurers may consider this normal wear and tear, which is not covered.

How to Maintain Your Flat Roof to Prevent Leaks

Preventative maintenance is crucial to extending the life of your flat roof and reducing the likelihood of leaks. Here are some tips:

- Regular Inspections: Check your roof at least twice a year and after severe weather events. Look for cracks, pooling water, or signs of damage.

- Clean the Roof: Remove debris, leaves, and moss to prevent blockages and water retention.

- Repair Minor Issues: Address small cracks or leaks promptly to prevent them from worsening.

- Professional Maintenance: Hire a roofing contractor for routine maintenance and inspections to catch potential problems early.

When to Replace Your Flat Roof

Even with proper maintenance, flat roofs will eventually need replacement. Signs that it may be time for a new roof include:

- Persistent leaks despite repairs.

- Visible cracks or sagging.

- An expired warranty or lifespan.

Replacing your roof before it becomes a serious issue can save you from costly repairs and potential insurance disputes.

Filing a Successful Insurance Claim

To improve your chances of a successful claim, follow these tips:

- Act Quickly: Report the damage as soon as you notice it. Delayed reporting can lead to claim denial.

- Provide Thorough Documentation: Include photos, professional assessments, and repair estimates to support your claim.

- Be Honest: Disclose all relevant details about the damage and its cause. Insurers may investigate claims thoroughly.

- Work with a Public Adjuster: If your claim is complicated, a public adjuster can help negotiate with your insurer.

Conclusion

If you’re wondering, “Can I claim on house insurance for leaking flat roof?“, the answer depends on your specific circumstances, including the cause of the leak, your insurance policy, and the steps you take to address the issue. While insurance may cover sudden and unexpected damage, it’s essential to maintain your flat roof to prevent avoidable problems.

By understanding your insurance coverage, documenting damage thoroughly, and maintaining your roof proactively, you can protect your home and increase the likelihood of a successful claim if needed.

Leave a Reply