Roof replacement is a significant home improvement project that can enhance your property’s value and protect it from the elements. However, it can also be a substantial financial investment. Many homeowners wonder whether they can offset some of the costs through tax deductions. In this article, we will explore the possibility of claiming a roof replacement on your taxes and provide you with essential information to help you navigate this aspect of homeownership.

Understanding Tax Deductions for Roof Replacement

Tax Benefits for Home Improvements

The U.S. Internal Revenue Service (IRS) offers various tax benefits for homeowners who make qualifying home improvements, including roof replacement. These benefits can help reduce your overall tax liability and make home improvements more affordable.

1. Home Improvement Tax Credits

In the past, there were federal tax credits available for certain energy-efficient roof replacements. However, as of my last knowledge update in September 2021, these credits had expired. It’s essential to check the current tax laws and consult a tax professional to determine if any new credits have been introduced.

2. Home Office Deduction

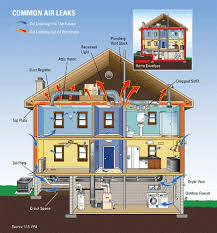

If you use a portion of your home exclusively for business purposes and you replace the roof on that part of your home, you may be eligible for a home office deduction. This deduction can include a portion of your roof replacement expenses. However, it’s crucial to ensure that you meet the IRS’s strict criteria for a home office deduction.

3. Casualty Loss Deduction

In some cases, if your roof replacement is a result of a casualty event, such as storm damage or a fallen tree, you may be able to claim a casualty loss deduction. This deduction allows you to deduct a portion of your unreimbursed expenses related to the damage. Keep detailed records and consult with a tax professional to determine if your situation qualifies.

4. Capital Improvement

A roof replacement is generally considered a capital improvement rather than a deductible expense. While you cannot deduct the full cost of the replacement in the year it occurs, you may be able to include it in the cost basis of your home. This can be beneficial when calculating capital gains tax when you sell your property in the future.

5. State and Local Tax Deductions

In addition to federal tax benefits, some states and local jurisdictions offer their own tax incentives for home improvements, including roof replacement. Check with your state and local tax authorities to explore potential deductions or credits available in your area.

Conclusion

While there may not be direct federal tax credits for roof replacement at the time of my last update, there are still potential avenues for homeowners to explore. It’s crucial to stay informed about changes in tax laws and consult with a tax professional to maximize any available deductions or credits. Keep detailed records of your roof replacement expenses, especially if it is related to a qualifying home office or casualty event. Roof replacement can enhance your home’s value and protect it from the elements, and understanding the tax implications can help you manage the financial aspects of this important home improvement project.

Leave a Reply