Homeownership comes with a range of financial responsibilities, including the maintenance and repair of your property. When it’s time to replace your roof, the costs can be substantial. However, there’s good news for homeowners: you may be able to claim roof replacement expenses on your taxes. In this article, we’ll delve into the details of claiming roof replacement on taxes, the eligibility criteria, and how you can maximize your tax benefits.

Understanding Tax Deductions for Roof Replacement

Qualified Home Improvement

Roof replacement qualifies as a home improvement expense, and in some cases, it may be tax-deductible. To be eligible for tax deductions, the replacement must be a significant improvement to your home, which generally means that it adds value, prolongs the life of the property, or adapts your home to new uses. Roof replacement meets these criteria because it protects your home’s structure and enhances its energy efficiency.

Itemized Deductions

To claim roof replacement on taxes, you’ll need to itemize your deductions instead of taking the standard deduction. This means you’ll need to keep detailed records of all expenses related to your roof replacement, including materials, labor, and any permits or fees.

Medical Expense Deductions

In some cases, if you have a medical condition that makes it necessary for you to replace your roof (for example, if mold growth is affecting your health), you may be able to claim the expense as a medical deduction if it’s prescribed by a medical professional.

Eligibility Criteria for Claiming Roof Replacement on Taxes

Ownership and Use

To claim roof replacement on taxes, you must own the property for which the roof was replaced. Additionally, the property must be your primary residence, not a rental or vacation property. You cannot claim roof replacement expenses for a property that you don’t live in.

Improvement Requirement

As mentioned earlier, the roof replacement must be a significant improvement to your home. Routine maintenance and repairs do not qualify for tax deductions. To ensure eligibility, it’s advisable to consult with a tax professional or refer to IRS guidelines.

Record Keeping

Proper documentation is essential when claiming roof replacement on taxes. You should keep detailed records of all expenses related to the replacement, including invoices, receipts, and any communication with contractors. This documentation will be necessary when you file your taxes.

Maximizing Your Tax Benefits

Consult a Tax Professional

Navigating the tax code can be complex, and tax laws can change from year to year. To ensure you’re making the most of the available deductions, it’s advisable to consult a tax professional or CPA who can provide expert guidance and ensure compliance with current tax regulations.

Consider Energy Efficiency Upgrades

If you’re replacing your roof, consider investing in energy-efficient roofing materials. Some energy-efficient upgrades may qualify for additional tax incentives or rebates, further reducing the overall cost of your roof replacement.

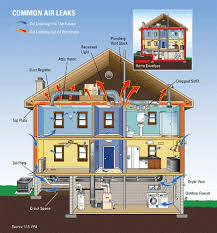

Keep Records for Other Home Improvements

In addition to roof replacement, there may be other home improvements that are tax-deductible. Keep detailed records for any eligible expenses related to improving your home, such as adding insulation, installing energy-efficient windows, or upgrading your HVAC system.

Conclusion

While claiming roof replacement on taxes is possible, it’s essential to understand the eligibility criteria and requirements to ensure compliance with tax laws. Proper documentation and consultation with a tax professional are key to maximizing your tax benefits. Roof replacement is a significant investment in your home’s maintenance and value, and if you meet the criteria, the potential tax deductions can provide valuable financial relief. Be sure to stay informed about the latest tax regulations and consult a tax expert to make the most of your eligible deductions.

Leave a Reply