When it comes to home improvements, few upgrades have gained as much popularity in recent years as installing a metal roof. Homeowners across the country are opting for metal roofs not only for their durability and energy efficiency but also for potential financial benefits. One question that often arises is, “Does a metal roof lower your insurance?” In this article, we’ll explore the relationship between metal roofs and insurance premiums, shedding light on the potential savings and considerations homeowners should keep in mind.

The Benefits of Metal Roofs

Before diving into the impact of metal roofs on insurance premiums, let’s first understand why these roofs have become so appealing to homeowners. Metal roofs offer a multitude of benefits that make them a wise choice for any home.

- Durability: Metal roofs are renowned for their longevity. Unlike traditional asphalt shingle roofs that may need replacement every 15-20 years, metal roofs can last 50 years or more. This durability not only provides peace of mind but also minimizes long-term maintenance costs.

- Energy Efficiency: Metal roofs reflect the sun’s rays, helping to keep your home cooler in the summer. This can result in reduced energy consumption for air conditioning, leading to lower utility bills.

- Weather Resistance: Metal roofs are highly resistant to extreme weather conditions, including heavy rain, hail, snow, and wind. This can significantly decrease the likelihood of roof damage and subsequent insurance claims.

- Eco-Friendly: Many metal roofs are made from recycled materials and are themselves recyclable at the end of their lifespan, making them an environmentally friendly choice.

- Increased Home Value: Installing a metal roof can increase the resale value of your home. Potential buyers are often willing to pay more for a home with a durable and energy-efficient roof.

The Relationship Between Metal Roofs and Insurance Premiums

Now that we’ve established the advantages of metal roofs, let’s explore how they can impact your homeowners’ insurance premiums.

- Potential Premium Reduction: Yes, having a metal roof can lead to a reduction in your insurance premiums. Insurance companies often consider the risk of damage to your home when determining your premium rates. Since metal roofs are highly resistant to weather-related damage, insurance companies view them as a lower risk. As a result, they may offer discounts to homeowners with metal roofs.

- Impact on Homeowners Claims: Metal roofs can also reduce the frequency of homeowners’ insurance claims. When your roof is less likely to sustain damage from storms or other natural disasters, you’re less likely to file a claim. This can lead to a lower risk profile in the eyes of your insurance provider, potentially resulting in lower premiums.

- Qualification for Discounts: Some insurance companies have specific policies in place that reward homeowners for investing in protective measures like metal roofs. These policies may offer discounts or credits to offset the cost of your insurance premium. It’s essential to check with your insurance provider to see if they offer such incentives.

- Local Regulations: Insurance regulations can vary by state and even by local jurisdiction. In some areas prone to extreme weather events, such as hurricanes or tornadoes, having a metal roof may be a requirement to obtain homeowners’ insurance. In such cases, the impact on premiums may not be a matter of choice but rather a necessity to secure coverage.

Considerations for Installing a Metal Roof

While the potential for insurance premium reductions is enticing, there are a few important considerations to keep in mind when contemplating a metal roof installation.

- Upfront Costs: Metal roofs typically have a higher upfront cost compared to traditional asphalt shingles. While the long-term savings on maintenance and energy bills can offset this expense, it’s essential to budget accordingly.

- Home Aesthetics: Some homeowners may have aesthetic preferences that lean toward traditional roofing materials. It’s crucial to choose a roofing material that aligns with your home’s overall look and feel.

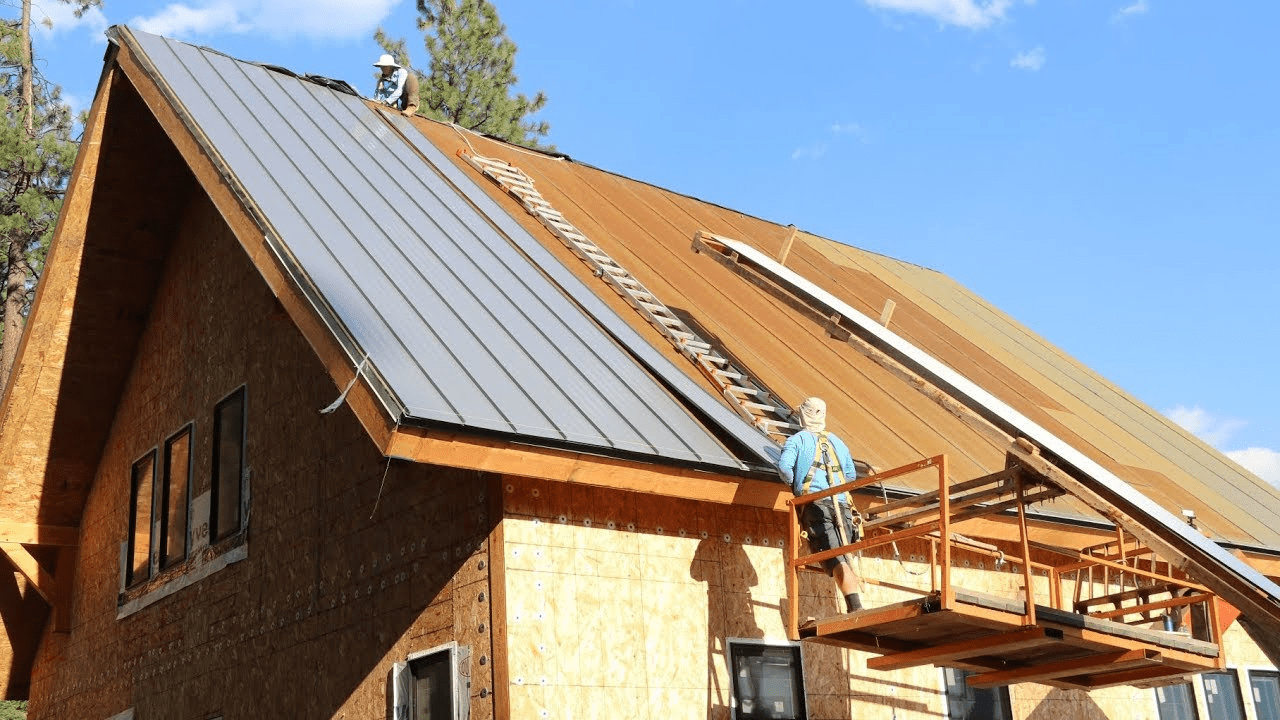

- Professional Installation: To reap the benefits of a metal roof, it’s imperative to have it installed by experienced professionals. Improper installation can lead to issues down the road.

Conclusion

In conclusion, the question “Does a metal roof lower your insurance?” has a positive answer for many homeowners. The durability, energy efficiency, and weather resistance of metal roofs make them an attractive option for those looking to reduce their insurance premiums and protect their homes. However, it’s important to weigh the upfront costs and aesthetic considerations before making a decision. Ultimately, the choice of roofing material should align with your long-term goals for your home, including potential insurance savings. If you’re considering a metal roof, consult with your insurance provider to explore available discounts and incentives in your area.

Leave a Reply