Florida, known for its sunny weather and occasional hurricanes, poses unique challenges when it comes to home maintenance and insurance costs. Many Florida homeowners are turning to metal roofs as a solution to both. In this article, we’ll explore whether installing a metal roof can lower your insurance premiums in the Sunshine State.

Understanding the Florida Home Insurance Landscape

Insurance Costs in Florida

Florida is notorious for having some of the highest home insurance rates in the United States. This is primarily due to its vulnerability to natural disasters, including hurricanes, tropical storms, and flooding. Homeowners in Florida are well aware of the financial burden that insurance premiums can place on their budgets.

Factors Affecting Home Insurance Premiums

Several factors influence the cost of homeowners’ insurance in Florida:

- Location: Homes located in high-risk areas, such as those near the coast, are likely to have higher insurance premiums.

- Construction: The type of construction materials used for your home’s roof, walls, and foundation can affect your insurance rates.

- Roof Type: The material of your roof plays a significant role in determining insurance costs. This is where metal roofing comes into play.

Metal Roofing and Insurance Premiums

The Benefits of Metal Roofs

Metal roofs offer several advantages that can potentially lead to lower insurance premiums:

- Durability: Metal roofing is highly durable and can withstand extreme weather conditions, including hurricanes. Insurance companies may offer lower premiums to homeowners with roofs that are less prone to storm damage.

- Fire Resistance: Metal roofs are non-combustible, reducing the risk of fire-related damage. This can result in discounts on your insurance policy.

- Longevity: Metal roofs have a longer lifespan compared to traditional roofing materials, which means fewer claims for roof replacement over the years.

- Energy Efficiency: Many metal roofing materials are reflective and can reduce cooling costs during hot Florida summers, making your home more energy-efficient and potentially lowering your premiums.

Impact on Insurance Premiums

While metal roofs can offer benefits that lower the risk of damage and loss, whether they directly reduce your insurance premiums in Florida depends on several factors:

- Insurance Provider: Some insurance companies may offer discounts for certain roofing materials, including metal. However, not all providers may offer this benefit, so it’s essential to shop around.

- Roof Age: The age of your metal roof can also influence insurance discounts. A brand-new metal roof may be more likely to qualify for reductions than an older one.

- Roof Installation: Proper installation by a licensed roofing contractor is crucial. Insurance companies may require documentation of the installation to consider offering discounts.

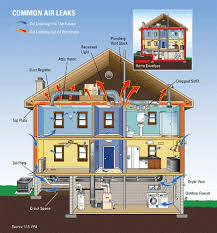

- Additional Home Features: Other protective features in your home, such as hurricane shutters or impact-resistant windows, may also impact your insurance rates.

Conclusion

While installing a metal roof can offer various benefits, including increased durability and energy efficiency, whether it directly lowers your insurance premiums in Florida can vary from one insurance provider to another. To determine the potential cost savings and eligibility for discounts, it’s essential to discuss your roofing material and its features with your insurance company.

In Florida, where the weather can be unpredictable, protecting your home and reducing insurance costs is a top priority for homeowners. A metal roof can be a wise investment that not only offers peace of mind during storms but may also lead to long-term savings on insurance premiums.

Leave a Reply