Your roof is one of the most critical components of your home, protecting you from rain, snow, wind, and the harsh effects of the sun. But when severe weather, falling trees, or unexpected damage strikes, the cost of roof repair or replacement can be overwhelming. That’s when homeowners ask the crucial question: “How to claim on house insurance for a new roof?”

Filing an insurance claim for roof damage may seem daunting, but with the right preparation and knowledge, you can successfully navigate the process. This article provides a detailed, step-by-step guide to help you file your claim, maximize your coverage, and ensure your new roof is covered fairly by your insurer.

Read too: Is It Reasonable to Ask the Seller to Replace the Roof?

Why Roof Insurance Claims Matter

A roof replacement can easily cost between $8,000 and $20,000 depending on size, materials, and complexity. For many homeowners, paying out of pocket simply isn’t an option. Understanding how to claim on house insurance for a new roof can save you thousands of dollars and reduce stress after storm damage or unexpected disasters.

Insurance claims not only help with the financial burden but also ensure your home is restored quickly, preventing further damage such as leaks, mold, or compromised structural integrity.

What Type of Roof Damage Is Covered by Insurance?

Before filing a claim, you need to know whether your damage is eligible for coverage. Most standard homeowners insurance policies cover sudden and accidental damage but exclude wear and tear.

Typically Covered:

- Storm damage (hail, wind, lightning)

- Fallen trees or branches

- Fire damage

- Vandalism

Typically Not Covered:

- Gradual deterioration

- Lack of maintenance

- Normal aging or old roofs

- Cosmetic-only issues (minor discoloration, stains)

The key is proving that the damage resulted from an unexpected event rather than regular wear.

How To Claim On House Insurance For A New Roof

Here’s a step-by-step breakdown of how to navigate the claims process effectively:

Step 1: Assess the Damage

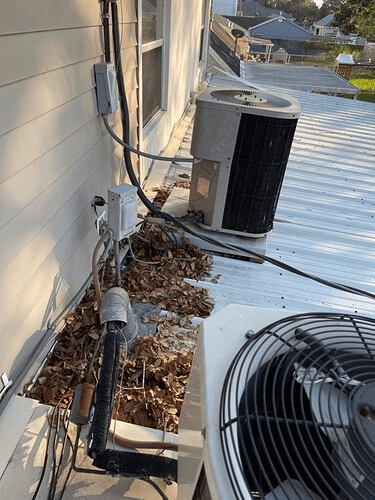

Immediately after the incident, safely inspect your roof from the ground. Look for:

- Missing or curled shingles

- Holes or punctures

- Sagging areas

- Water leaks inside your home

If it’s safe, take clear photos and videos of the visible damage. These will serve as crucial evidence for your claim.

Step 2: Review Your Insurance Policy

Before calling your insurer, review your homeowner’s policy. Pay attention to:

- Coverage details for roof damage

- Deductible amounts

- Exclusions (e.g., age of roof restrictions)

Some policies won’t cover roofs older than 20 years or may only reimburse depreciated value rather than full replacement.

Step 3: Contact Your Insurance Company

Notify your insurance provider as soon as possible. Provide basic details:

- Date and cause of the damage

- Initial description of damage

- Photos or video evidence

Prompt reporting prevents delays and strengthens your case.

Step 4: Schedule a Professional Roof Inspection

Most insurers will send an adjuster to assess the damage. However, hiring your own licensed roofing contractor ensures you have an independent estimate. Contractors often spot details adjusters may miss.

Step 5: Meet the Adjuster

When the insurance adjuster arrives:

- Be present during the inspection.

- Provide your evidence (photos, receipts for temporary repairs).

- Ask questions about the process and coverage.

This is your chance to ensure nothing is overlooked.

Step 6: Get Multiple Estimates

Don’t rely on just one opinion. Request written estimates from at least two or three roofing companies. Compare them to the adjuster’s report for accuracy.

Step 7: File the Claim Form

Complete the necessary paperwork provided by your insurer. Submit:

- Photos/videos

- Contractor estimates

- Any receipts for emergency repairs (tarps, temporary fixes)

Keep copies of everything for your records.

Step 8: Review the Settlement Offer

Your insurer will send a settlement letter outlining how much they’ll pay. Review carefully to ensure:

- The damage is fully accounted for.

- Depreciation deductions are clear.

- Payment terms are transparent.

If you disagree, you can request a reinspection or appeal the decision.

Step 9: Hire a Contractor and Begin Repairs

Once approved, choose your contractor and schedule the roof replacement. Make sure they’re licensed, insured, and experienced in insurance claim work.

Step 10: Keep Records for Future Reference

File all documents, invoices, and insurance correspondence. These may be needed if you sell your home or file another claim later.

Common Mistakes to Avoid

When learning how to claim on house insurance for a new roof, many homeowners make costly mistakes:

- Delaying the Claim – Waiting too long can weaken your case.

- Skipping Documentation – Lack of photos and records reduces your credibility.

- Accepting the First Offer Blindly – Insurers may undervalue damage initially.

- Not Reading Policy Details – Assumptions about coverage can lead to disappointment.

- DIY Repairs Before Inspection – Making permanent fixes before the adjuster visits may void your claim.

Tips to Maximize Your Roof Insurance Claim

- Act Quickly – The sooner you file, the smoother the process.

- Stay Organized – Keep a dedicated folder for claim-related documents.

- Use Professional Language – Treat every interaction with your insurer like a business transaction.

- Leverage Contractor Expertise – Many roofing companies assist with claim paperwork.

- Know Your Rights – You can appeal or hire a public adjuster if needed.

When to Consider a Public Adjuster

If your claim is denied or underpaid, hiring a public adjuster may be worthwhile. Unlike insurance company adjusters, public adjusters work for you. They can:

- Reassess roof damage.

- Negotiate with insurers.

- Help maximize settlement amounts.

They usually charge a percentage of the final settlement but often secure much higher payouts.

Preventing Future Claim Issues

While you can’t prevent every storm, you can make future claims easier by:

- Keeping roof maintenance records.

- Scheduling annual roof inspections.

- Saving receipts for repairs.

- Updating your policy regularly.

This shows your insurer that you’ve taken proactive steps to maintain your roof.

Final Thoughts

So, how to claim on house insurance for a new roof? The process involves careful documentation, prompt communication with your insurer, and strategic planning. By understanding your policy, gathering strong evidence, and working with professionals, you can secure the coverage you deserve for a new roof.

Your roof is too important to leave unprotected. Follow these steps, avoid common mistakes, and you’ll be well-prepared to navigate the insurance claim process with confidence.

Leave a Reply