In the ever-evolving landscape of home improvement, integrating energy-efficient solutions is more beneficial than ever. One such opportunity is the Roof Replacement Solar Tax Credits, a valuable incentive for homeowners considering both roof upgrades and solar energy installations. This guide will explore what the Roof Replacement Solar Tax Credit is, how it works, and how you can take advantage of it to save money on your home improvement projects.

What is the Roof Replacement Solar Tax Credit?

The Roof Replacement Solar Tax Credit is a financial incentive provided by the federal government to encourage homeowners to upgrade their roofs and incorporate solar energy systems. This credit allows homeowners to receive a percentage of the cost of roof replacement and solar installations back as a tax credit.

Read too: How To Replace A Mobile Home Roof: Step-by-Step Guide for Homeowners

How It Works

- Eligibility: To qualify for the Roof Replacement Solar Tax Credit, your roof replacement must be part of a project that includes the installation of solar panels or a solar energy system. The credit applies to both new roof installations and replacements that are necessary to support a solar energy system.

- Credit Amount: The amount of the tax credit can vary based on the cost of the roof replacement and solar system. Typically, it’s a percentage of the total cost, with specific percentages set by federal guidelines. For instance, the tax credit might cover 30% of the cost of both the roof replacement and solar installation.

- Application: To claim the tax credit, you must file IRS Form 5695, “Residential Energy Credits,” when you file your annual tax return. You will need to provide documentation of your expenditures on roof replacement and solar energy systems.

Benefits of the Roof Replacement Solar Tax Credit

Opting for the Roof Replacement Solar Tax Credit offers several benefits, making it an attractive option for many homeowners:

1. Significant Savings

The primary benefit of the Roof Replacement Solar Tax Credit is the potential for significant savings. By covering a percentage of the costs associated with both roof replacement and solar installation, this credit can reduce your out-of-pocket expenses considerably.

2. Increased Home Value

Upgrading your roof and installing a solar energy system can increase the value of your home. Prospective buyers often find energy-efficient homes more appealing, which can lead to a higher resale value.

3. Reduced Energy Bills

Solar energy systems can drastically reduce your monthly energy bills. With solar panels generating your own electricity, you can lower or even eliminate your reliance on traditional energy sources.

4. Environmental Impact

Using solar energy reduces your carbon footprint and contributes to a more sustainable environment. By taking advantage of the tax credit, you are supporting renewable energy and helping combat climate change.

How to Qualify for the Roof Replacement Solar Tax Credit

To qualify for the Roof Replacement Solar Tax Credit, follow these guidelines:

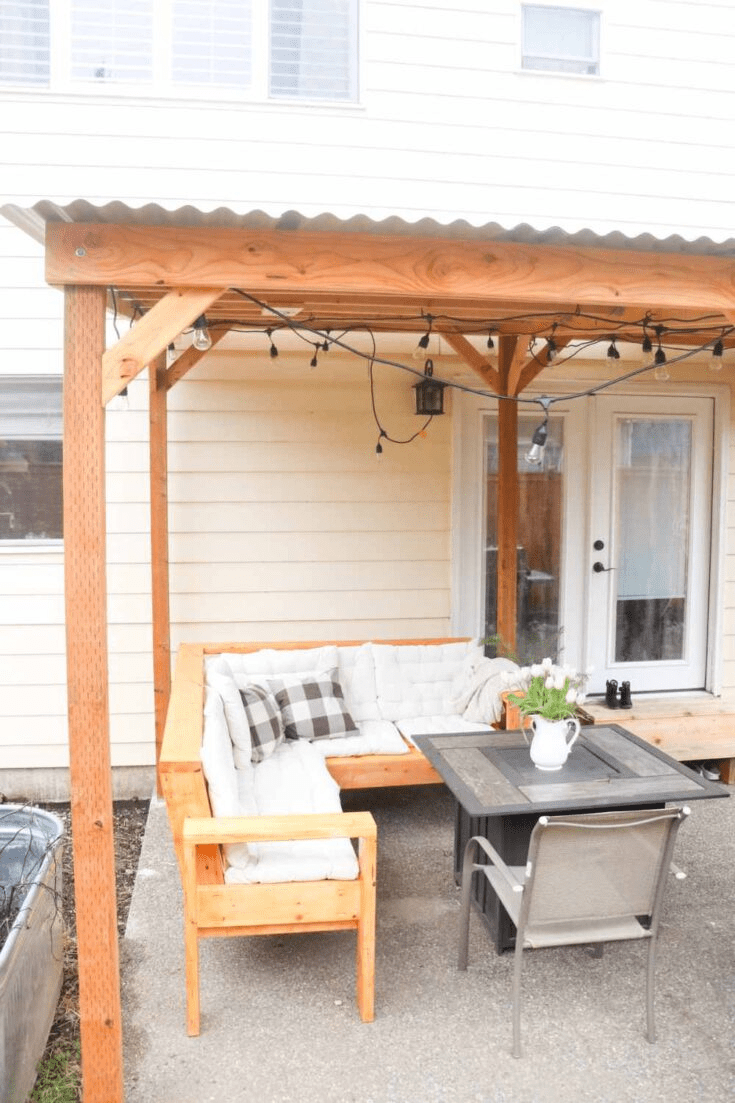

1. Ensure Roof Compatibility

Your new or replaced roof must be compatible with solar panel installation. This often means choosing a roof material that is suitable for solar panels and ensuring that the structure can support the weight and installation of the system.

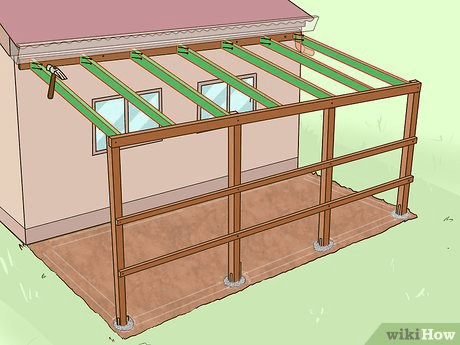

2. Install a Solar Energy System

The Roof Replacement Solar Tax Credit applies only if you install a solar energy system as part of your roof replacement project. Ensure that the solar panels and equipment meet the necessary standards for federal tax credits.

3. Keep Detailed Records

Maintain detailed records of all expenses related to the roof replacement and solar energy system installation. This includes receipts, invoices, and contracts. Proper documentation is essential for claiming the tax credit.

4. Complete the Necessary Forms

File IRS Form 5695 with your tax return. This form is used to claim residential energy credits, including those for solar energy systems and qualifying roof replacements.

Steps to Take Advantage of the Roof Replacement Solar Tax Credit

To make the most of the Roof Replacement Solar Tax Credit, follow these steps:

1. Evaluate Your Roof

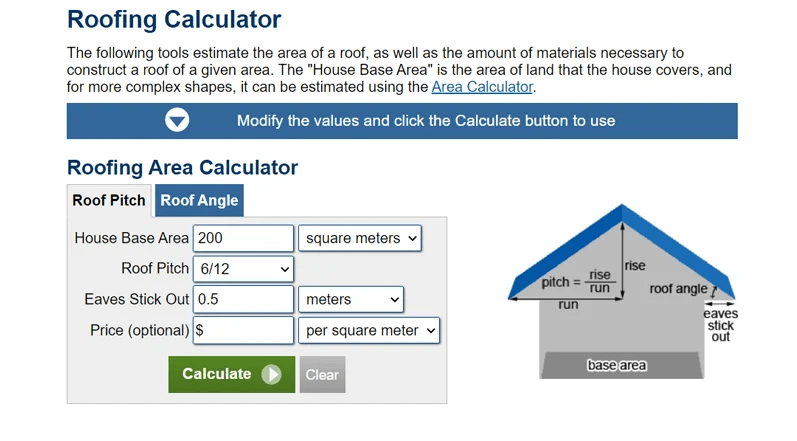

Assess whether your current roof needs replacement and if it is suitable for solar panel installation. Consult with roofing and solar energy professionals to determine the best course of action.

2. Obtain Quotes

Get quotes from reputable contractors for both the roof replacement and solar energy system installation. Compare costs and ensure that the quotes include all necessary components to qualify for the tax credit.

3. Plan Your Project

Coordinate the timing of your roof replacement and solar installation to maximize efficiency and ensure that both projects are completed as required for the tax credit.

4. Apply for the Tax Credit

Once your projects are completed, gather all documentation and file IRS Form 5695 with your tax return. Ensure that you accurately report all expenses related to the roof replacement and solar energy system.

Common Mistakes to Avoid

When applying for the Roof Replacement Solar Tax Credit, avoid these common mistakes:

1. Not Meeting Eligibility Requirements

Ensure that both your roof replacement and solar energy system meet the eligibility requirements for the tax credit. Failure to comply with these requirements can result in denial of the credit.

2. Failing to Keep Documentation

Proper documentation is crucial for claiming the tax credit. Failing to keep detailed records of your expenses can hinder your ability to receive the credit.

3. Misunderstanding Credit Amounts

Be aware of the current percentage rates for the tax credit and how they apply to your project. Tax credit amounts can change, so it’s essential to stay informed about current guidelines.

Conclusion

The Roof Replacement Solar Tax Credits offers a valuable opportunity for homeowners to save money on roof upgrades and solar energy installations. By understanding the benefits, qualifying requirements, and application process, you can make informed decisions that maximize your savings and contribute to a more sustainable future. If you’re considering a roof replacement and solar energy system, take advantage of this tax credit to enhance your home’s value, reduce your energy bills, and support renewable energy initiatives.

Leave a Reply