Roof replacement is a significant expense that many business owners face at some point in the life of their commercial property. However, did you know that you may be able to take advantage of tax benefits for roof replacement under Section 179 of the Internal Revenue Code? In this article, we’ll explore what Section 179 is, how it applies to roof replacement, and the potential tax advantages it offers to business owners.

Understanding Section 179

Section 179 allows businesses to deduct the full purchase price of qualifying assets in the year of purchase, rather than over multiple years. This deduction is designed to encourage businesses to invest in capital assets and stimulate economic growth.

Applying Section 179 to Roof Replacement

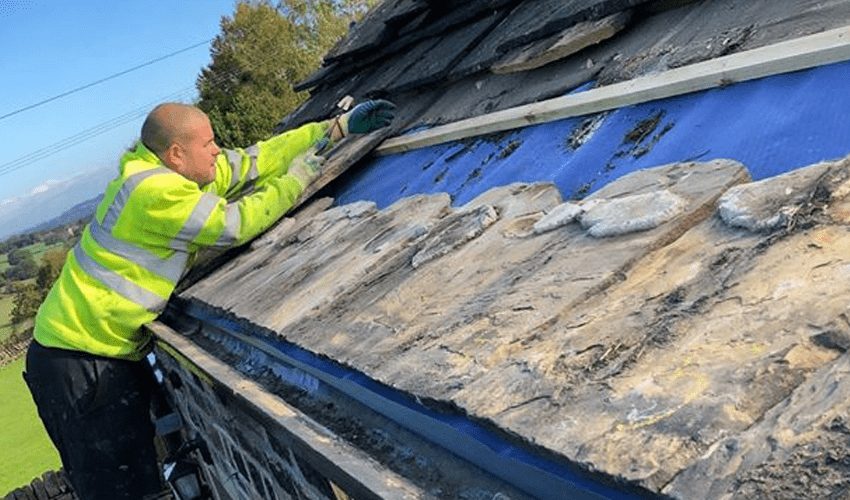

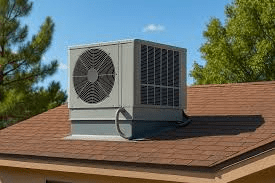

Qualifying Roofing Improvements: Section 179 applies to select roofing improvements that boost energy efficiency in commercial properties. This includes the installation of energy-efficient roofing materials, such as cool roofing or reflective roofing systems.

- Deductible Expenses:Under Section 179, the cost of qualifying roofing improvements can be deducted from your business’s taxable income in the year the project is completed. This can lead to substantial tax savings for business owners.

Key Considerations for Section 179 Roof Replacement

Eligibility:To qualify for roof replacement, your roofing project must meet specific energy efficiency standards set by the IRS. Consult with a tax professional or accountant to determine if your project qualifies.

- Expense Limit:There is a maximum expense limit set by the IRS each year for Section 179 deductions. For the tax year 2023, this limit is $1,050,000. Be aware of this limit when planning your roofing project and potential deductions.

- Consult a Tax Professional:Navigating the complexities of tax codes can be challenging. Partner with a Section 179-savvy tax professional to optimize deductions and ensure tax compliance.

Claiming Section 179 Deductions for Roof Replacement

Complete the Roof Replacement: Ensure IRS energy efficiency compliance and complete your roofing project within the tax year for deduction.

- Maintain Documentation:Keep detailed records of all expenses related to the roofing project, including invoices, receipts, and any certifications related to energy efficiency.

- Consult Your Tax Advisor:Before claiming Section 179 deductions on your tax return, consult with your tax advisor or accountant. They will guide you through the process and help you complete the necessary forms and documentation.

Conclusion

Section 179 offers tax benefits for energy-efficient roof replacement. It allows full deduction of qualifying improvements in the year completed, potentially saving you taxes. Consult a tax professional for guidance due to its complexity and compliance requirements. By taking advantage of this tax benefit, business owners can invest in energy-efficient roofing while enjoying financial advantages.

Leave a Reply