If you’re a landlord, you’ve probably asked yourself: Why Can’t I Fully Deduct Roof Replacement for Rent House? After all, replacing a roof is expensive, and it feels like a necessary expense to keep your rental property livable. Unfortunately, U.S. tax law doesn’t always treat big expenses the way property owners expect.

This article explains why roof replacement costs usually can’t be deducted all at once, how the tax rules work, and what smart landlords can do to stay compliant while maximizing tax benefits.

Read too: How To Replace Roof Shingles That Blew Off: A Comprehensive Guide

Why Can’t I Fully Deduct Roof Replacement for Rent House Under IRS Rules?

The short answer: because a roof replacement is considered a capital improvement, not a repair.

According to the U.S. tax system (enforced by the Internal Revenue Service), expenses for rental properties fall into two main categories:

- Repairs and maintenance

- Capital improvements

Only repairs can usually be deducted in full in the year you pay for them. Capital improvements must be depreciated over time, which is why you can’t fully deduct a roof replacement in one year.

Repair vs. Capital Improvement: What’s the Difference?

Understanding this distinction is critical for landlords.

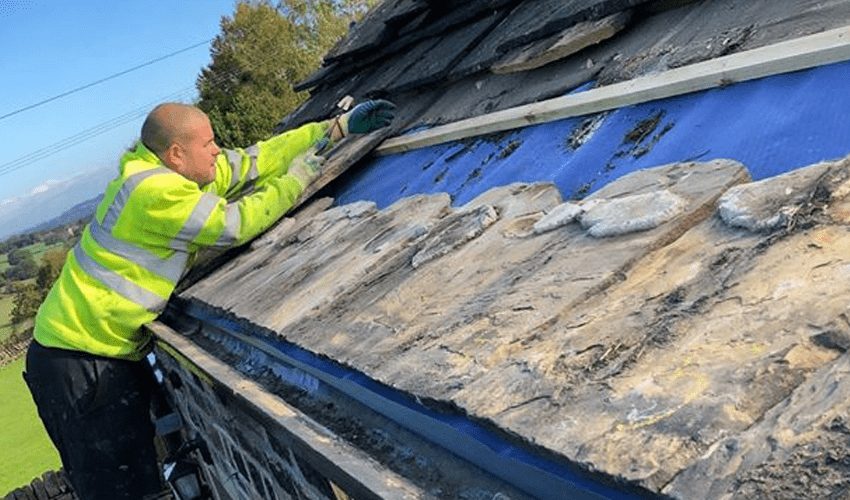

Repairs

Repairs fix something that’s already there and keep the property in good working condition.

Examples:

- Fixing a small roof leak

- Replacing a few damaged shingles

- Patching holes caused by weather

👉 These costs are fully deductible in the same tax year.

Capital Improvements

Capital improvements add value, extend the property’s useful life, or adapt it for a new use.

Examples:

- Replacing the entire roof

- Upgrading from asphalt shingles to metal roofing

- Structural changes that extend longevity

👉 These must be capitalized and depreciated, not deducted immediately.

A full roof replacement almost always qualifies as a capital improvement.

How Depreciation Works for Roof Replacement on a Rental Property

Residential Rental Property Depreciation

For residential rental properties in the U.S., depreciation follows this rule:

- 27.5 years recovery period

- Straight-line depreciation

This means your roof replacement cost is spread evenly across 27.5 years.

Example Calculation

Let’s say:

- Roof replacement cost: $22,000

Annual deduction:

- $22,000 ÷ 27.5 = $800 per year (approximately)

Instead of deducting $22,000 at once, you deduct about $800 each year.

This is the main reason landlords feel frustrated when asking, “Why can’t I fully deduct roof replacement for rent house?”

Why the IRS Treats Roof Replacement Differently

The IRS logic is based on long-term value.

A new roof:

- Increases property value

- Extends the useful life of the building

- Benefits you for decades

Because the benefit is long-term, the tax deduction is also spread out over time.

This principle is consistent with general accounting standards and is explained further in depreciation concepts such as those outlined on Wikipedia’s page about depreciation (external authoritative source).

Is There Any Way to Deduct More of the Roof Cost Faster?

Yes—while you usually can’t deduct the full cost immediately, there are strategies that may accelerate deductions.

1. Partial Asset Disposition

If your old roof was separately accounted for:

- You may be able to write off the remaining value of the old roof

- This can create a larger deduction in the replacement year

This approach often requires professional tax guidance.

2. Cost Segregation Study (Advanced Strategy)

A cost segregation study breaks a property into components with shorter depreciation lives.

Potential benefits:

- Some roof-related components may qualify for faster depreciation

- Larger deductions in earlier years

⚠️ Best suited for high-value rental properties due to cost and complexity.

3. Section 179 (Usually Not Applicable to Residential Rentals)

Section 179 typically applies to:

- Commercial property

- Business equipment

For most residential rental houses, Section 179 does not apply to roof replacements.

Roof Repair vs Roof Replacement: Side-by-Side Comparison

| Expense Type | Example | Deductible Immediately? |

|---|---|---|

| Roof repair | Fixing leaks | ✅ Yes |

| Roof repair | Replacing shingles | ✅ Yes |

| Roof replacement | Full tear-off & install | ❌ No |

| Roof upgrade | Metal or solar roof | ❌ No |

Common Mistakes Landlords Make with Roof Deductions

Avoid these costly errors:

- ❌ Deducting a full roof replacement as a repair

- ❌ Mixing repair and improvement costs incorrectly

- ❌ Not keeping invoices or contractor documentation

- ❌ Failing to depreciate improvements properly

These mistakes can increase audit risk and lead to penalties.

How to Properly Report Roof Replacement on Your Tax Return

Step-by-Step Overview

- Save all invoices from contractors

- Classify the expense as a capital improvement

- Add the cost to your property’s basis

- Begin depreciation in the year the roof is placed in service

- Track depreciation annually using IRS-approved methods

Most landlords report this using Schedule E with their Form 1040.

Does Insurance Reimbursement Change Deductibility?

Yes.

- If insurance pays for part of the roof replacement:

- You can only depreciate the amount you paid, not the reimbursed portion.

- If insurance covers the entire cost:

- There may be no depreciation deduction at all.

Always subtract insurance proceeds before calculating depreciation.

FAQ: Roof Replacement Tax Deductions for Rental Property

Q1: Why can’t I fully deduct roof replacement for rent house in one year?

Because the IRS classifies a full roof replacement as a capital improvement, which must be depreciated over 27.5 years.

Q2: Can I deduct roof repairs instead of replacement?

Yes. Minor fixes and maintenance are usually considered repairs and are fully deductible in the same year.

Q3: What if I replace only part of the roof?

If it restores rather than improves, it may qualify as a repair. Large-scale replacements usually still count as improvements.

Q4: Can I deduct roof replacement when selling the rental property?

The cost increases your cost basis, which can reduce capital gains tax when you sell.

Q5: Does a new roof qualify for bonus depreciation?

Generally no, especially for residential rentals. Some components may qualify under special circumstances.

Conclusion

So, why can’t I fully deduct roof replacement for rent house? Because tax law treats a new roof as a long-term investment, not a short-term expense. While this can feel frustrating, understanding depreciation rules helps you stay compliant and plan smarter.

By classifying expenses correctly, keeping strong records, and using strategic tax planning, landlords can still gain meaningful tax benefits over time.

👉 If you found this guide helpful, share it with fellow landlords or on social media—someone else is probably asking the same question.

Leave a Reply