Dealing with roof damage can be a stressful situation for any homeowner. When you’re faced with the situation where my insurance company only wants to replace only half my roof, it can add another layer of confusion and concern. In this article, we’ll explore the reasons behind such decisions and provide insights into how to navigate the process of roof replacement when faced with the scenario of your insurance company wanting to replace only half of your roof.

Understanding Insurance Company Decisions

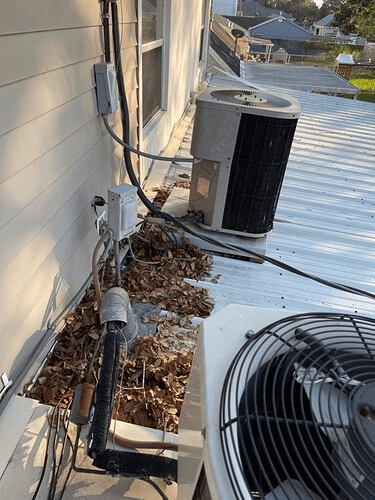

- Assessing Damage: Insurance companies typically send out adjusters to assess the extent of the roof damage. These professionals evaluate the damage and determine the necessary repairs or replacements based on their assessment. If only one area of your roof is damaged while the other remains intact, the adjuster might recommend replacing only the damaged portion.

- Cost Considerations: Insurance companies take into account the cost of repairs or replacements when making decisions. If the damage is limited to one section of your roof, it might be more cost-effective for them to replace only that portion rather than the entire roof.

- Policy Coverage: The terms of your insurance policy also play a role in the decisions made. Certain policies cover partial roof replacements; others demand substantial damage for full replacement approval.

Navigating the Process

- Request Detailed Assessment: If uncertain about half-roof replacement, ask for a detailed assessment report from the insurance adjuster. This report should outline the reasons behind their decision, including photographs and a breakdown of the damage.

- Consult with Roofing Professionals: Before agreeing to any repairs or replacements, it’s advisable to consult with roofing professionals. A reputable roofing contractor can provide an unbiased assessment of the damage and recommend the best course of action based on their expertise.

- Review Your Policy: Take the time to review your insurance policy to understand the coverage and terms. If damage warrants full roof replacement, talk to your insurer and refer to policy terms.

Making an Informed Decision

- Safety and Longevity: Partial roof replacement appears cost-effective but assess safety and longevity. Blending new materials with existing ones can be tough, impacting overall roof performance and aesthetics.

- Future Insurance Claims: If you agree to a partial roof replacement now and face further damage in the future, it could complicate insurance claims. Inconsistent roofing materials could lead to disputes with your insurance company during future claims.

Conclusion: Advocate for Your Roof’s Integrity

When my insurance company only wants to replace only half my roof, it’s essential to make informed decisions that prioritize the integrity and longevity of your home’s structure. While cost considerations are important, safety and long-term protection should not be compromised. Consult pros, review policy, and advocate for a solution ensuring roof performance, appearance, and insurance compliance. It’s your home’s first line of defense, and ensuring its strength is a decision that should be made with care.

Leave a Reply