Discovering water stains on your ceiling or walls after a storm can be stressful and expensive. Many homeowners immediately ask, “Does House Insurance Cover Water Damage From Leaking Roof?” The answer isn’t always simple. This guide explains what homeowners insurance typically covers, what it excludes, and how to protect yourself financially if your roof leaks.

Does House Insurance Cover Water Damage From Leaking Roof? (Short Answer)

The most common question homeowners ask is straightforward:

Does house insurance cover water damage from leaking roof?

The Short Answer:

Yes—sometimes. Coverage depends on why the roof leaked and whether the damage was sudden and accidental or caused by neglect and wear.

Insurance companies focus less on the water itself and more on the cause of the leak.

How Homeowners Insurance Typically Works With Roof Leaks

Homeowners insurance is designed to cover unexpected events, not long-term maintenance problems.

Generally Covered Scenarios

- Sudden storm damage

- Wind or hail tearing shingles

- Fallen tree or debris impact

- Ice dams causing water intrusion

Commonly Denied Scenarios

- Old or worn-out roofing

- Poor maintenance

- Long-term slow leaks

- Mold caused by ongoing moisture

Read too: How Long Do Standing Seam Metal Roofs Last? A Comprehensive Guide to Durability and Longevity

According to insurance industry data, over 50% of denied water damage claims involve maintenance-related roof issues.

What Types of Water Damage From a Leaking Roof Are Usually Covered?

Insurance coverage often applies to secondary damage, not the roof itself.

Covered Interior Damage May Include:

- Ceiling drywall

- Wall insulation

- Flooring and carpets

- Electrical systems

- Personal belongings (depending on policy)

💡 Important:

The roof repair itself may not be covered unless the damage was caused by a covered peril.

What Causes of Roof Leaks Are Covered by Insurance?

Insurance companies use the term “covered peril.”

Common Covered Perils

- Windstorms

- Hail

- Snow load collapse

- Falling objects

- Fire-related roof damage

If water enters your home because of one of these events, the damage is usually covered.

When Does House Insurance NOT Cover Water Damage From a Leaking Roof?

Understanding exclusions is just as important.

Common Exclusions

- Aging shingles past lifespan

- Cracked flashing not repaired

- Poor workmanship

- Long-term seepage

- Mold caused by delayed repairs

Insurance providers expect homeowners to perform reasonable maintenance. A neglected roof is considered preventable damage.

Sudden Damage vs Gradual Damage: Why It Matters

This distinction is critical for claims approval.

| Type of Damage | Coverage Likelihood |

|---|---|

| Storm-created hole | High |

| Tree impact | High |

| Ice dam leak | Often covered |

| Slow leak over months | Usually denied |

| Rot from age | Denied |

Insurance companies document whether damage happened quickly or over time.

Does Insurance Cover Mold From a Leaking Roof?

This is a frequently misunderstood area.

Mold Coverage Depends On:

- Cause of the leak

- Speed of homeowner response

- Policy mold limits

If mold results from sudden water damage and is addressed quickly, coverage may apply. Mold from ignored leaks is almost always excluded.

How to File an Insurance Claim for Water Damage From a Roof Leak

If you believe your claim qualifies, follow these steps carefully.

Step-by-Step Claim Process

Step 1: Stop the Damage Immediately

Use tarps or buckets to prevent further water intrusion.

Step 2: Document Everything

- Take photos and videos

- Record dates and weather events

- Save damaged materials if possible

Step 3: Contact Your Insurance Company Promptly

Delays can weaken your claim.

Step 4: Schedule an Inspection

An adjuster will assess:

- Cause of damage

- Roof condition

- Maintenance history

Step 5: Keep All Repair Receipts

Temporary repairs are often reimbursable.

How Much Does Insurance Typically Pay for Roof Leak Damage?

Payout depends on coverage type.

Actual Cash Value (ACV)

- Pays depreciated value

- Older roofs receive less

Replacement Cost Value (RCV)

- Pays full replacement cost

- Requires completing repairs first

Many homeowners are surprised to learn their roof coverage is ACV-only.

Does Insurance Cover Roof Replacement After a Leak?

Sometimes—but not always.

Roof Replacement Is Usually Covered If:

- Damage was caused by a covered peril

- Roof wasn’t already deteriorated

- Policy includes replacement coverage

Roof Replacement Is Usually NOT Covered If:

- Roof exceeded lifespan

- Damage resulted from neglect

- Leak existed before policy started

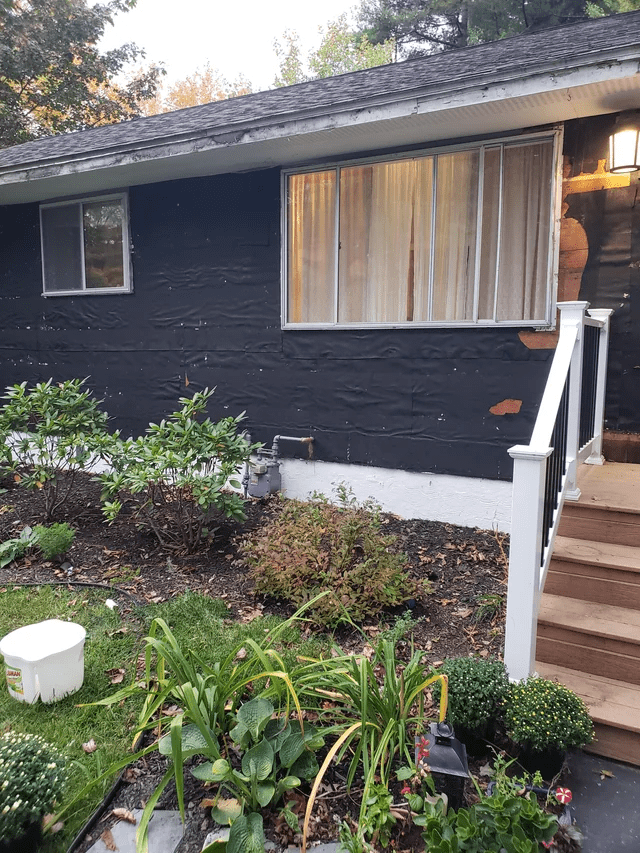

How Insurance Companies Investigate Roof Leak Claims

Adjusters look for signs of:

- Long-term water staining

- Soft or rotted decking

- Multiple layers of repairs

- Moss or algae growth

These indicators suggest ongoing issues, not sudden events.

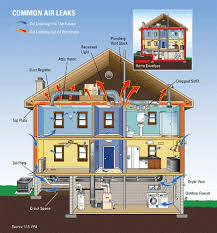

Does Location and Climate Affect Roof Leak Coverage?

Yes. Regional risks influence claim outcomes.

Examples:

- Ice dams (Northern states)

- Hurricane damage (Coastal areas)

- Heavy hail (Midwest)

Policies are often tailored to local weather risks.

How to Reduce the Risk of Claim Denial

Preventive steps improve both coverage and home safety.

Best Practices

- Annual roof inspections

- Prompt repair of missing shingles

- Clean gutters twice per year

- Maintain flashing and vents

- Keep maintenance records

Insurance experts estimate that documented maintenance reduces claim disputes by up to 40%.

Roof Leak Insurance Coverage: Pros and Cons

✅ Advantages

- Protects against sudden disasters

- Covers interior damage

- Helps with emergency repairs

❌ Disadvantages

- Maintenance exclusions

- Deductibles may be high

- Roof depreciation reduces payouts

Understanding limitations avoids surprises.

Is Home Insurance Enough Protection Against Roof Leaks?

Insurance is reactive—not preventive.

Many homeowners combine:

- Regular inspections

- Roof warranties

- Emergency repair funds

This layered approach offers the strongest protection.

Authoritative Reference

For general background on how homeowners insurance works, see:

👉 https://en.wikipedia.org/wiki/Home_insurance

FAQ: Does House Insurance Cover Water Damage From Leaking Roof

Q1: Does homeowners insurance cover ceiling water damage from a roof leak?

Yes, if the leak was caused by a covered peril like a storm.

Q2: Will insurance pay for an old roof that leaks?

Usually no. Age-related wear is considered maintenance.

Q3: Is water damage from rain always covered?

Only if rain entered due to sudden damage, not pre-existing leaks.

Q4: How long do I have to file a roof leak claim?

Most insurers require prompt reporting—often within days.

Q5: Can insurance deny a claim if I didn’t notice the leak right away?

Yes. Delayed action can result in denial due to negligence.

Conclusion

So, does house insurance cover water damage from leaking roof?

The answer depends on cause, timing, and maintenance history. Insurance is designed to protect you from sudden, unexpected damage—not preventable wear and tear.

Understanding your policy and acting quickly can make the difference between approval and denial. If this guide helped you, share it on social media to help other homeowners avoid costly surprises 💧🏠

Leave a Reply