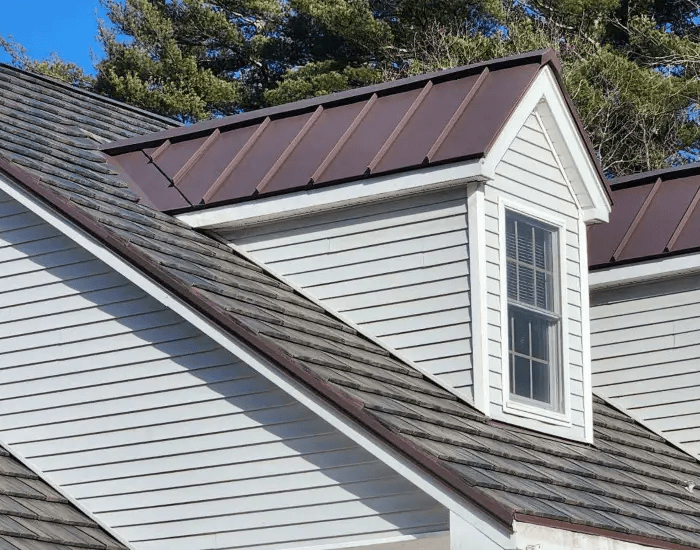

Upgrading your roof can be a significant investment, but with the right choices, you might also benefit from substantial tax credits. One such opportunity is the Energy Star Metal Roof Tax Credit. This article will delve into what this tax credit entails, how you can qualify, and the benefits of installing an Energy Star-rated metal roof.

What is the Energy Star Metal Roof Tax Credit?

Understanding the Tax Credit

The Energy Star Metal Roof Tax Credit is a federal incentive designed to encourage homeowners and businesses to invest in energy-efficient roofing solutions. By installing a metal roof that meets Energy Star’s efficiency criteria, property owners can potentially receive a tax credit that reduces the overall cost of the roofing project.

- Energy Star Program: A program by the U.S. Environmental Protection Agency (EPA) that promotes energy efficiency through product certifications.

- Metal Roofs: Roofing systems made from metals such as steel, aluminum, or copper, known for their durability and energy efficiency.

Read too: How To Replace A Mobile Home Roof: Step-by-Step Guide for Homeowners

Benefits of Energy Star Metal Roofs

- Energy Efficiency: Energy Star metal roofs reflect solar heat, reducing cooling costs in hot climates.

- Durability: Metal roofs are long-lasting and resistant to extreme weather conditions.

- Environmental Impact: Energy Star metal roofs contribute to reduced energy consumption and lower greenhouse gas emissions.

How to Qualify for the Tax Credit

Criteria for Eligibility

To qualify for the Energy Star Metal Roof Tax Credit, the roofing material must meet specific criteria set by the Energy Star program. These criteria ensure that the roof provides significant energy savings and environmental benefits.

- Reflectivity: The roof must have a high solar reflectance to reduce heat absorption.

- Emissivity: The roof should have high thermal emissivity to release absorbed heat effectively.

- Certification: The roof must be certified by Energy Star to qualify for the tax credit.

Installation Requirements

- Professional Installation: The roof should be installed by a certified professional to ensure compliance with Energy Star standards.

- Documentation: Keep all documentation, including receipts and Energy Star certification, to claim the tax credit.

Tax Credit Amount

The amount of the tax credit can vary based on the specifics of the installation and the total cost of the project. Typically, the credit percentage is applied to the cost of the roofing materials and installation, up to a certain limit.

Application Process for the Tax Credit

Claiming the Tax Credit

To claim the Energy Star Metal Roof Tax Credit, follow these steps:

- Verify Eligibility: Ensure your metal roof meets Energy Star’s criteria and is installed by a qualified professional.

- Gather Documentation: Collect all necessary documents, including proof of purchase, installation receipts, and Energy Star certification.

- File Your Taxes: Include the tax credit information on your federal tax return. Use IRS Form 5695 for residential energy credits.

Working with a Tax Professional

Consulting a tax professional can help ensure that you accurately complete the necessary forms and maximize your tax benefits. They can provide guidance on documentation requirements and assist with any questions about the tax credit.

Advantages of Energy Star Metal Roofs

Financial Savings

- Reduced Cooling Costs: By reflecting solar heat, Energy Star metal roofs can lower your air conditioning expenses, especially in hot climates.

- Increased Property Value: An energy-efficient roof can enhance your property’s value and appeal to potential buyers.

Environmental Benefits

- Lower Energy Consumption: Energy Star metal roofs contribute to reduced energy use and lower greenhouse gas emissions.

- Sustainable Choice: Metal roofs are often made from recycled materials and are fully recyclable at the end of their lifespan.

Considerations for Installing an Energy Star Metal Roof

Cost vs. Savings

- Initial Investment: Energy Star metal roofs may have a higher upfront cost compared to traditional roofing materials.

- Long-Term Savings: The long-term energy savings and tax benefits can offset the initial investment, making it a cost-effective choice over time.

Choosing the Right Roof

- Material Options: Consider different metal roofing materials such as aluminum, steel, or copper, each with unique benefits and costs.

- Design and Aesthetics: Choose a roof design and color that complement your home’s architecture and meet Energy Star’s efficiency standards.

Maintenance

- Regular Inspections: Schedule periodic inspections to ensure the roof remains in good condition and continues to perform efficiently.

- Cleaning: Keep the roof clean to maintain its reflectivity and performance.

Conclusion

The Energy Star Metal Roof Tax Credit presents a valuable opportunity for homeowners and businesses to invest in energy-efficient roofing solutions while benefiting from financial incentives. By choosing an Energy Star-certified metal roof, you can enjoy long-term energy savings, enhanced property value, and a positive environmental impact. Ensure you meet the eligibility criteria, gather the necessary documentation, and consult with a tax professional to maximize your benefits.

Leave a Reply