When it comes to homeownership, unexpected events like storms, hail, or fallen tree branches can damage your roof. If you find yourself in a situation where only part of your roof needs replacing, you may wonder whether your insurance will cover it. Filing a claim for a roof repair can feel daunting, especially if you’re unsure whether the insurance will replace only half of the roof. In this article, we’ll break down everything you need to know about when and how insurance replaces half a roof, the process of filing a claim, and how to make sure you get the coverage you deserve.

Understanding Roof Damage and Insurance Coverage

When a storm or accident damages your roof, the first thing you might think of is calling your insurance company. However, it’s important to understand how your homeowner’s insurance works, what it covers, and how insurance companies decide whether to replace or repair only part of your roof.

Read too: Hail Damage Roof Repair: Essential Guide to Restoring Your Home’s Protection

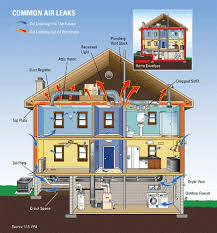

Most standard homeowner’s insurance policies cover roof damage caused by “perils,” which include events like storms, fire, hail, or wind. However, wear and tear, poor maintenance, and issues like gradual deterioration are typically excluded.

Here’s where things can get tricky—when only part of your roof is damaged, your insurance company may opt to replace just that section instead of covering a full roof replacement. Whether your insurance will replace half of the roof depends on several factors, which we’ll explore in detail below.

How Does Insurance Replace Half a Roof?

The idea of insurance replacing only half a roof might sound strange, but it happens more often than you’d think. In many cases, when only a portion of the roof is damaged—like one side or a specific section—insurers may argue that only the damaged area needs fixing. They base their decision on the severity and scope of the damage.

When assessing roof damage, insurers often categorize damage as either “cosmetic” or “functional.” Cosmetic damage refers to issues that don’t affect the roof’s performance, such as slight discoloration or shingle fading. Functional damage, on the other hand, affects the roof’s ability to protect the home. If only one section of the roof is functionally damaged, they may only approve a partial replacement.

Situations Where Insurance May Replace Half of a Roof

- Localized Damage: If the damage is contained to one specific area of your roof, such as a tree limb falling on one side, your insurer may only cover that part.

- Matching Issues: Insurers may replace only the damaged half of your roof if it’s possible to find materials that match the undamaged portion. However, if matching materials aren’t available, your policy’s “matching” clause could come into play.

- State Regulations: Some states have regulations requiring insurers to replace an entire roof if a partial replacement would result in mismatched materials. Check your state’s laws and speak to your insurance company about their specific practices.

- Age of the Roof: Insurance companies may factor in the age of your roof when determining how much to cover. If your roof is nearing the end of its lifespan, the insurance may cover a depreciated amount for a partial replacement.

Factors Affecting Insurance Decisions on Partial Roof Replacement

There are several factors insurance companies take into account when deciding whether to cover a full or partial roof replacement. Understanding these can help you better navigate the claim process and possibly increase your chances of getting a full roof replacement.

The Extent of the Damage

If the damage is significant, insurers are more likely to approve a full roof replacement. For example, if a storm rips off large sections of your roof or if widespread hail damage affects the entire roof’s functionality, insurers may approve full replacement. However, if the damage is localized, such as a single spot affected by a fallen tree branch, they may only approve a half replacement.

Your Policy’s Specific Terms

The wording of your homeowner’s insurance policy plays a significant role in determining what’s covered. Some policies have clauses that specify whether partial or full roof replacements are approved under certain conditions. Make sure to read your policy carefully and ask your insurance agent for clarification if needed.

Depreciation

Insurance companies often factor in depreciation when calculating the payout for a roof replacement. If your roof is old, insurers may offer you only a portion of the replacement cost, based on the roof’s age and condition. This can influence whether they approve a full or partial replacement.

Matching Clauses

Some homeowner insurance policies include a “matching” clause, which requires the insurer to match new materials to existing ones. If matching materials are unavailable, this clause could force the insurer to replace the entire roof. However, not all policies include this clause, so it’s essential to review your policy’s fine print.

The Process of Filing an Insurance Claim for a Partial Roof Replacement

Filing an insurance claim for a roof replacement, whether partial or full, requires some preparation and understanding of the process. Here’s a step-by-step guide to help you through the claim process.

1. Assess the Damage

After the damage occurs, it’s important to assess the condition of your roof. You can either inspect it yourself (with proper safety precautions) or hire a professional roofing contractor to evaluate the extent of the damage. A contractor can provide a detailed report, including photos, which will be valuable when filing a claim.

2. Contact Your Insurance Company

Once you have an idea of the damage, contact your insurance company to report the issue. They will typically send an adjuster to inspect your roof and determine the scope of the damage. Make sure to document everything and keep records of all communication with your insurance company.

3. Get an Estimate from a Roofing Contractor

It’s a good idea to have a licensed roofing contractor provide an estimate for the repairs or replacement. If the contractor finds significant damage that affects the entire roof, they can provide documentation to support a full roof replacement.

4. Understand Your Deductible

Before filing a claim, ensure you understand your policy’s deductible. If the cost of the repair or replacement is less than your deductible, it may not make sense to file a claim. Also, remember that filing multiple claims in a short period could affect your premiums or coverage.

5. Cooperate with the Adjuster

The insurance adjuster will inspect your roof and decide whether a partial or full replacement is necessary. It’s crucial to cooperate fully with the adjuster and provide any supporting documentation that demonstrates the need for a full replacement, especially if your roof’s age, matching issues, or state regulations come into play.

6. Review the Insurance Company’s Decision

Once the adjuster makes their recommendation, your insurance company will issue a settlement offer. If they approve only a half-roof replacement but you believe a full replacement is warranted, you may be able to appeal the decision or negotiate for better coverage. In some cases, hiring a public adjuster to represent your interests can be helpful.

What to Do If Your Insurance Won’t Cover a Full Roof Replacement

If your insurance company refuses to cover a full roof replacement, there are still options available. You can negotiate with your insurer, present additional evidence (such as a contractor’s report), or file an appeal. In some cases, taking legal action may be necessary, but this should be a last resort after exhausting all other avenues.

It’s also a good idea to review your policy before filing a claim to understand the specifics of your coverage. Consider upgrading your policy or adding endorsements that provide better coverage for roof repairs and replacements in the future.

Conclusion

Understanding how “Insurance Replace Half Roof” works can save you a lot of frustration when dealing with roof damage claims. Whether your insurer replaces half the roof or the entire thing depends on several factors, including the extent of the damage, your policy’s terms, and matching materials. By being prepared, knowing your policy, and working closely with roofing contractors and insurance adjusters, you can increase your chances of getting the coverage you need.

Remember, the key is to document everything, communicate effectively with your insurer, and advocate for the best possible outcome for your home. Roof damage can be stressful, but with the right information, you’ll be able to navigate the claims process with confidence.

Leave a Reply