When it comes to roof replacement, many homeowners rely on their insurance coverage to help alleviate the financial burden. However, navigating the insurance claim process can be complex, and understanding the right questions to ask is crucial. In this article, we will discuss the important insurance roof replacement questions you should ask to ensure a smooth and successful claim experience. Whether you’re filing a claim for storm damage or general wear and tear, read on to gain valuable insights and maximize your insurance coverage.

Does My Insurance Policy Cover Roof Replacement?

The first question to ask is whether your insurance policy covers roof replacement. Review your policy documents or contact your insurance provider to determine the extent of coverage for roof replacement. Some policies may cover only specific types of damage, such as hail or wind damage, while others may include broader coverage for general wear and tear.

What Damage Is Covered Under My Policy?

Understanding the specific types of damage covered under your insurance policy is essential. Ask your insurance provider for a detailed explanation of the covered perils, such as hail, windstorms, fire, or falling objects. This knowledge will help you determine if the damage to your roof qualifies for a claim.

Are There Any Exclusions or Limitations?

Insurance policies often have exclusions or limitations that may affect your roof replacement claim. Ask your insurance provider about any specific exclusions, such as damage caused by lack of maintenance, pre-existing conditions, or neglect. Additionally, inquire about any limitations on coverage, such as depreciation or maximum payout amounts.

What Documentation Do I Need for a Roof Replacement Claim?

To support your roof replacement claim, proper documentation is crucial. Ask your insurance provider about the specific documentation they require. Typically, this may include photographs of the damage, estimates from roofing contractors, and any relevant repair or maintenance records. Gathering these documents early on will help expedite the claim process.

How Does the Claims Process Work?

Understanding the claims process is vital for a smooth roof replacement experience. Ask your insurance provider about the step-by-step process, including how to file a claim, the timeline for inspection, and the documentation required. Inquire about any deductibles or out-of-pocket expenses you may need to cover and how the reimbursement process works.

Can I Choose My Own Roofing Contractor?

In some cases, insurance policies allow policyholders to choose their own roofing contractor for the replacement. Ask your insurance provider if you have the freedom to select a contractor of your choice or if they have a list of preferred contractors. Research and select a reputable contractor with experience in insurance claims to ensure quality workmanship and a seamless process.

What Happens If Additional Damage Is Discovered During the Replacement?

During the roof replacement process, it’s not uncommon for additional damage to be discovered once the old roof is removed. Inquire about how your insurance provider handles such situations. Understand whether they will cover the additional damage or if you need to submit a supplemental claim. It’s crucial to address any unforeseen damage promptly to avoid delays and ensure proper coverage.

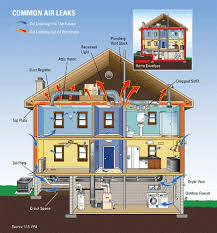

Are There Any Steps I Can Take to Prevent Future Damage?

As you go through the insurance roof replacement process, it’s essential to ask about preventive measures to avoid future damage. Seek advice from your insurance provider or roofing contractor on steps you can take to protect your roof, such as regular maintenance, gutter cleaning, or installing protective coatings. Taking preventive measures can help extend the life of your new roof and potentially reduce the risk of future insurance claims.

Conclusion:

When it comes to insurance roof replacement, asking the right questions is key to understanding your coverage, navigating the claims process, and ensuring a successful outcome. By inquiring about coverage, damage types, exclusions, documentation requirements, claims process, contractor selection, handling additional damage, and preventive measures, you can maximize your insurance benefits and protect your home with a new roof. Remember, open communication with your insurance provider and a reputable roofing contractor will help you navigate the insurance claim process smoothly.

Leave a Reply