Navigating the complexities of IRS Solar Tax Credits Roof Replacement can significantly impact your decision-making process when considering solar energy and roof upgrades.

IRS Solar Tax Credit Roof Replacement Explained

The IRS Solar Tax Credit Roof Replacement is a financial incentive provided by the U.S. government to encourage homeowners and businesses to invest in renewable energy solutions while replacing or upgrading their roofs.

Eligibility for IRS Solar Tax Credit Roof Replacement

To qualify for the IRS Solar Tax Credit Roof Replacement, several criteria must be met:

- Installation Deadline: The solar panels and roof replacement must be completed by a specified deadline to qualify for the tax credit.

- Primary Residence: The property must be your primary residence to be eligible for the tax credit. Second homes and rental properties may have different eligibility criteria.

- IRS Guidelines: Compliance with IRS guidelines and regulations regarding solar energy systems and home improvements is essential to qualify for the tax credit.

Benefits of IRS Solar Tax Credit Roof Replacement

Investing in solar energy and roof replacement under the IRS tax credit offers several advantages:

- Financial Savings: The tax credit allows you to deduct a percentage of the cost of installing a solar energy system, including associated roof upgrades, from your federal taxes.

- Environmental Impact: By adopting solar energy, you contribute to reducing carbon emissions and reliance on fossil fuels, thereby promoting environmental sustainability.

- Home Value: Properties with solar energy systems often have increased market value and appeal to environmentally conscious buyers.

Steps to Claim IRS Solar Tax Credit Roof Replacement

Claiming the IRS Solar Tax Credit Roof Replacement involves specific steps:

- Consultation: Seek consultation from a qualified tax advisor or accountant to understand eligibility requirements and tax implications.

- Documentation: Maintain detailed records of expenses related to both the solar energy system installation and roof replacement.

- IRS Forms: Complete IRS Form 5695 to claim the Residential Energy Efficient Property Credit and ensure compliance with all IRS filing requirements.

Considerations Before Proceeding

Before embarking on a IRS Solar Tax Credit Roof Replacement project, consider the following factors:

- Costs and Financing: Evaluate the upfront costs of solar panel installation and roof replacement against long-term savings and tax benefits.

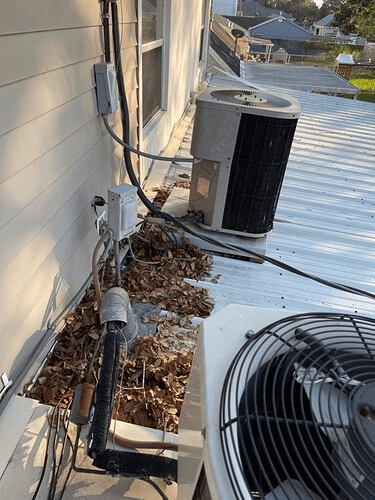

- Roof Compatibility: Ensure your roof is structurally sound and compatible with solar panel installation requirements to maximize efficiency and durability.

- Local Regulations: Familiarize yourself with local building codes, zoning laws, and homeowner association guidelines that may impact your project.

Read too: How To Replace Roof Shingles That Blew Off: A Comprehensive Guide

Conclusion

The IRS Solar Tax Credits Roof Replacement presents a valuable opportunity to upgrade your home with renewable energy solutions while benefiting from federal tax incentives. By understanding the eligibility criteria, financial benefits, and procedural requirements, homeowners can make informed decisions to enhance energy efficiency, reduce environmental impact, and increase property value.

Leave a Reply