Introduction

If your roof has seen better days—or recently took a hit from a storm—you may be wondering: “Is replacing a roof part of State Farm’s house insurance?”

It’s a smart question. Roof repairs and replacements can cost thousands of dollars, and understanding whether your policy covers those expenses can save you from unexpected financial stress.

Read too: Hail Damage Roof Repair: Essential Guide to Restoring Your Home’s Protection

In this article, we’ll break down exactly what State Farm covers, what it doesn’t, and how to successfully file a roof claim step-by-step.

Does State Farm Cover Roof Replacement?

The short answer: Yes, State Farm home insurance may cover roof replacement—but only if the damage was caused by a covered peril.

A covered peril means an event specifically listed in your homeowners policy that can trigger insurance coverage.

According to State Farm’s homeowners policy documents, these perils typically include:

- Windstorms or hail

- Falling objects (like trees or debris)

- Fire or smoke

- Lightning strikes

- Vandalism or theft

So, if a hailstorm damages your shingles or a tree crashes through your roof, State Farm generally covers repair or replacement costs (minus your deductible).

However, normal wear and tear, age, and poor maintenance are not covered.

Understanding Roof Coverage: Repair vs. Replacement

Not every roof issue results in a full replacement. Sometimes, your insurer will only pay for partial repairs.

| Situation | Coverage Type | Likely Outcome |

|---|---|---|

| Roof damaged by wind/hail | Covered peril | Full or partial replacement |

| Roof leaking due to age | Not covered | Denied claim |

| Roof collapse from heavy snow | Covered (depending on policy) | Replacement possible |

| Roof damage due to poor maintenance | Not covered | Denied claim |

Tip: Keep all inspection reports, photos, and maintenance records—they help prove your roof was in good condition before damage occurred.

Replacement Cost Value (RCV) vs. Actual Cash Value (ACV)

State Farm offers two main coverage types for roof claims:

1. Replacement Cost Value (RCV)

RCV pays the full cost to replace your roof with similar materials, without deducting for depreciation.

This option provides the best protection, especially for newer roofs.

2. Actual Cash Value (ACV)

ACV subtracts depreciation (the roof’s age and wear) from your payout.

Example:

If your 15-year-old roof is damaged and costs $12,000 to replace, you might only get $5,000 after depreciation.

| Coverage Type | You Receive | Best For |

|---|---|---|

| RCV | Full replacement cost | Homes with newer roofs |

| ACV | Depreciated value | Older roofs or budget policies |

Pro tip: Ask your State Farm agent which policy you have—RCV offers more complete protection.

How To File a Roof Claim With State Farm (Step-by-Step)

If your roof has storm damage or other covered peril, here’s exactly what to do:

1. Document the Damage Immediately

Take clear photos and videos from multiple angles.

Include close-ups of missing shingles, holes, or interior leaks.

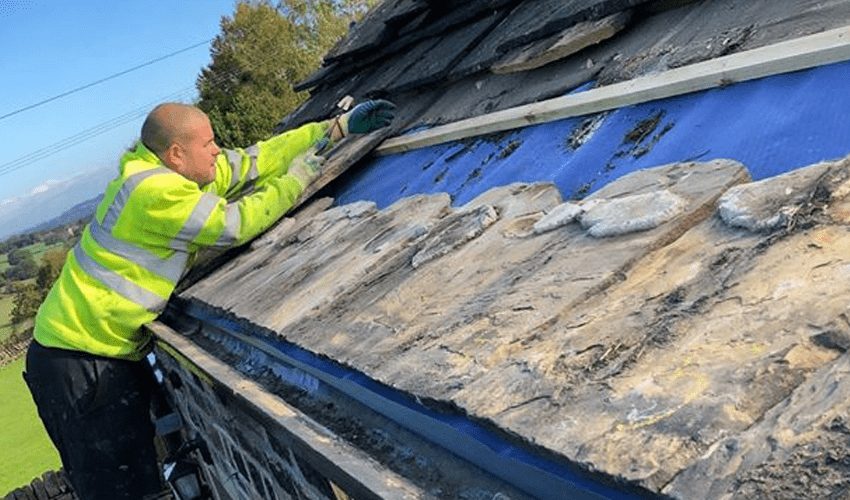

2. Prevent Further Damage

Cover holes with a tarp or temporary repair materials.

This shows you acted responsibly—something insurers look for when approving claims.

3. Contact State Farm Promptly

You can file a claim:

- Via the State Farm app or website

- By calling your local agent

- Through the 24-hour claims line

4. Schedule a Roof Inspection

A State Farm adjuster will visit your property to assess the cause and extent of the damage.

5. Get a Professional Estimate

Obtain at least two roofing contractor quotes.

Make sure the contractor is licensed and experienced with insurance claims.

6. Review Settlement Offer

Once approved, State Farm will issue a settlement check (minus your deductible).

If you have RCV coverage, you’ll receive an initial ACV payment, and the remaining amount after replacement completion.

What’s Not Covered by State Farm Home Insurance

While State Farm’s policies are comprehensive, there are clear exclusions. Your roof replacement will likely not be covered if the damage is caused by:

- Normal aging or wear and tear

- Improper installation or defective materials

- Neglected maintenance (e.g., mold or rot left unrepaired)

- Earthquakes or floods (unless you have separate coverage)

- Cosmetic hail damage that doesn’t impact function

Example:

If your 20-year-old roof simply reaches the end of its lifespan, State Farm will not pay for replacement because it’s considered maintenance-related deterioration.

Roof Age and Depreciation: How It Affects Coverage

Your roof’s age plays a big role in how much you’re reimbursed.

| Roof Age | Coverage Level | Explanation |

|---|---|---|

| 0–10 years | Full replacement likely | Strong RCV eligibility |

| 10–20 years | Partial coverage | Depreciation applies |

| 20+ years | Low coverage | Usually ACV or denied claim |

Most insurers, including State Farm, inspect roofs older than 15 years closely.

If your roof is over 20 years old, you may be required to upgrade or replace it before renewing your policy.

Tips to Maximize Your Roof Claim Approval

To improve your chances of getting approved and maximizing your payout:

- Maintain your roof annually – Clean gutters, remove debris, and fix small leaks early.

- Keep detailed records – Maintenance receipts and inspection reports build your case.

- Act fast after damage – File your claim within days, not weeks.

- Hire a public adjuster if your claim is large or complex.

- Don’t settle too quickly – Review every detail of your estimate for accuracy.

Case Example: Storm Damage Claim

Scenario:

A homeowner in Oklahoma experiences hail damage during a severe thunderstorm.

The roof is 8 years old and covered by an RCV State Farm policy.

Process:

- Photos and claim filed within 48 hours

- Adjuster confirms hail damage

- Total roof replacement cost: $18,500

- Deductible: $2,000

✅ Final payout: $16,500

✅ Outcome: Roof replaced, full coverage honored

This example shows that quick action and strong documentation lead to successful claims.

Expert Insight

According to the Insurance Information Institute (III):

“Most standard homeowners policies, including those from major insurers like State Farm, cover roof damage caused by sudden and accidental events, but not normal wear and tear.”

In other words, insurance is for unexpected damage, not predictable deterioration.

To learn more about home insurance principles, see Wikipedia’s Home Insurance page.

FAQ Section

1. Is replacing a roof part of State Farm’s house insurance?

Yes, but only if your roof is damaged by a covered peril like wind, hail, fire, or lightning—not regular wear and tear.

2. Does State Farm cover roof leaks?

It depends. Leaks caused by sudden damage (like a storm) are covered. Leaks from old age or neglect are not.

3. Will my premiums go up after a roof claim?

Possibly. One isolated weather-related claim may not, but multiple claims in a short period can increase your rates.

4. How long does State Farm take to approve a roof claim?

Usually between 1–3 weeks, depending on inspection scheduling and claim complexity.

5. Can I choose my own roofing contractor?

Yes. State Farm allows you to select your contractor, but they must be licensed, insured, and meet local building codes.

6. Does State Farm offer discounts for new roofs?

Yes. Many homeowners receive lower premiums after installing a new, impact-resistant roof.

Conclusion

So, is replacing a roof part of State Farm’s house insurance?

Yes — if your roof was damaged by a covered event like hail, wind, or fire.

Understanding your policy type (ACV vs. RCV), maintaining your roof, and filing claims correctly can make all the difference.

Replacing a roof is a big investment, but with the right coverage and preparation, you can protect both your home and your finances.

Leave a Reply