When it comes to maintaining a property, roof repairs are an inevitable part of ownership. However, deciding how to account for these repairs can be tricky, especially when it comes to distinguishing between capitalizing the cost or expensing it. The choice of whether to capitalize or expense roof repair has significant tax and financial implications for both businesses and homeowners. This article aims to provide a comprehensive guide on this subject, helping you understand the difference between capitalizing and expensing, and how to make the best decision for your roof repairs.

Understanding the Basics: Capitalize vs. Expense

Before diving into the specific issue of roof repair capitalize or expense, it’s important to understand what these two terms mean in the context of accounting.

Capitalizing Costs

When a cost is capitalized, it means that the expense is not immediately deducted. Instead, the cost is added to the balance sheet as an asset and depreciated over time. In essence, you spread the cost out over the useful life of the improvement or asset. For instance, if you install a new roof that is expected to last 20 years, the cost of the roof can be capitalized and depreciated over that period.

Expensing Costs

When you expense a cost, the full amount is deducted from your income in the same year the expense is incurred. This provides an immediate reduction in taxable income, which can be beneficial for tax purposes in the short term. Roof repairs that are considered routine maintenance or minor fixes often fall into this category.

Read too: How To Replace Roof Shingles That Blew Off: A Comprehensive Guide

How to Decide: Roof Repair Capitalize or Expense?

Now that we have a basic understanding of the difference between capitalizing and expensing, the next step is determining how to categorize roof repairs specifically. The IRS provides guidelines that can help distinguish between capital improvements and repairs, but there can still be some gray areas.

Roof Repair Capitalize or Expense: IRS Guidelines

The IRS differentiates between a repair, which is generally expensed, and an improvement, which is capitalized. According to the IRS:

- Repairs and maintenance: These are typically expensed. They include tasks that keep the property in its normal operating condition but don’t add significant value or extend its useful life. For example, patching a small leak or replacing a few damaged shingles would typically be considered a repair.

- Improvements: These are capitalized. If the work increases the value of the property, extends its life, or adapts the property to a new or different use, then the cost is generally considered an improvement. For instance, replacing an entire roof would likely be categorized as a capital improvement.

The Three-Prong Test

The IRS uses what is called the “three-prong test” to determine whether an expenditure should be capitalized. The three criteria are:

- Betterment: Does the work make the property better than it was before? If the roof is upgraded or enhanced beyond its original state, the costs should likely be capitalized.

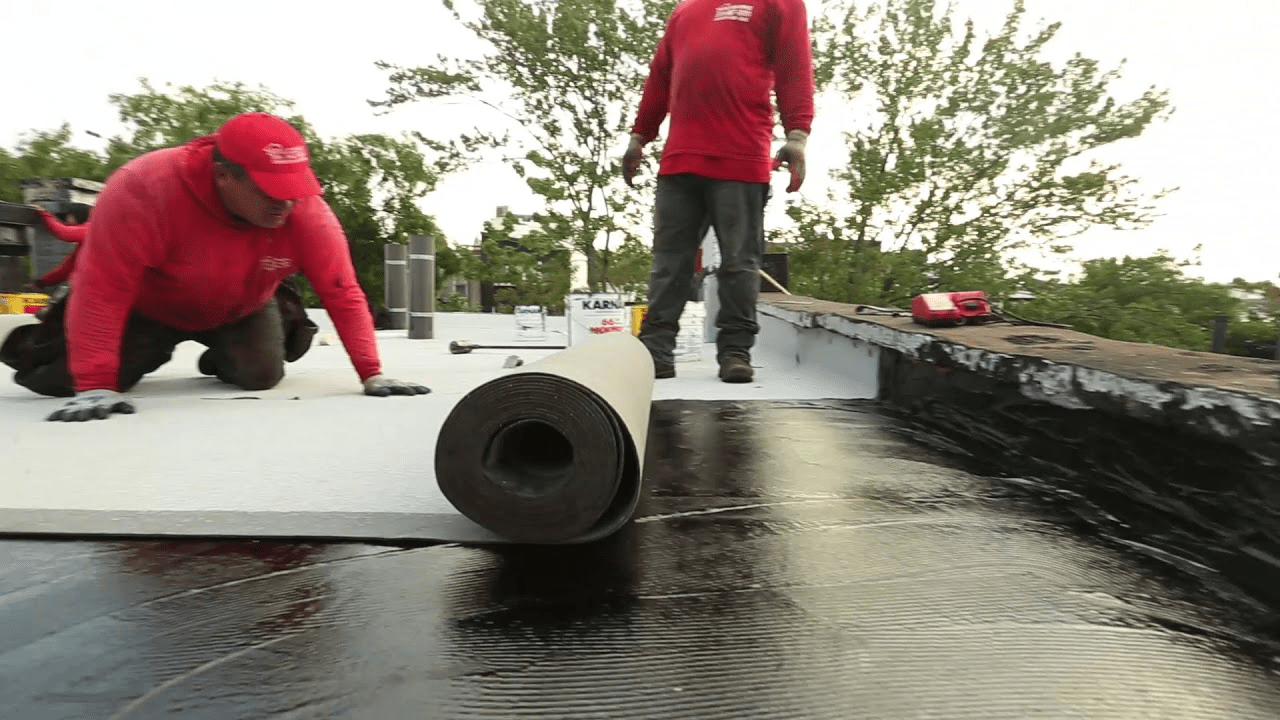

- Restoration: Does the work restore the property to a like-new condition? Large-scale roof repairs, such as replacing the roof after major damage, could be classified as restoration and therefore capitalized.

- Adaptation: Does the work change the use of the property? If the roof is being modified to serve a new function, like accommodating solar panels or additional levels, it’s considered an adaptation and should be capitalized.

Routine Repairs vs. Significant Improvements

One of the biggest challenges when determining whether to capitalize or expense roof repair is distinguishing between routine maintenance and significant improvements. Generally, routine repairs and maintenance tasks, such as cleaning gutters, repairing minor leaks, and replacing a few shingles, should be expensed. These activities maintain the roof’s normal functionality and don’t extend its lifespan significantly.

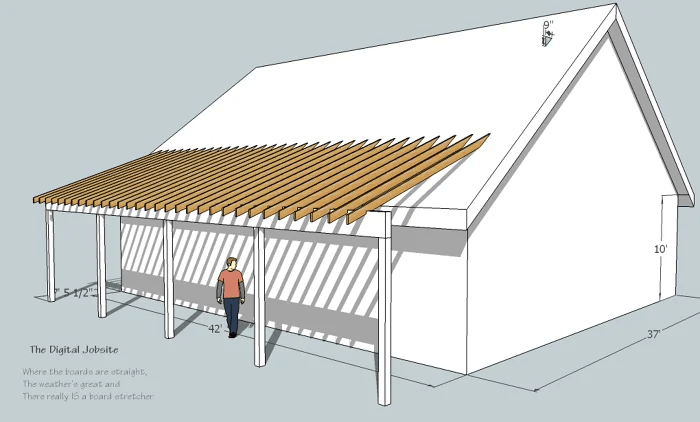

In contrast, replacing an entire roof, installing new weatherproofing, or upgrading the roofing material would be considered a significant improvement and should be capitalized. These improvements add substantial value to the property and extend its useful life, making them long-term investments.

Common Scenarios: Roof Repair Capitalize or Expense?

Let’s take a look at some common roof repair scenarios and determine whether the cost should be capitalized or expensed.

Scenario 1: Minor Roof Repairs

Imagine you discover a small leak in your roof caused by damaged shingles. You hire a roofer to patch the leak and replace a few shingles. This type of repair is minor and routine, and it does not significantly extend the life of the roof or add value to the property. In this case, the cost of the repair should be expensed.

Scenario 2: Replacing an Entire Roof

Now, imagine that your roof has reached the end of its useful life and needs to be completely replaced. This is a significant project that improves the value of the property and extends its life for many years to come. In this situation, the cost of the new roof should be capitalized and depreciated over its expected lifespan.

Scenario 3: Adding Insulation or Weatherproofing

Let’s say that you decide to add additional insulation and weatherproofing to your roof to improve energy efficiency. This could be seen as an improvement since it enhances the functionality and value of the property. Therefore, the cost should be capitalized and depreciated over time.

Scenario 4: Emergency Roof Repair After a Storm

Your roof suffers damage from a major storm, and you need to repair large sections of it to prevent further damage. This type of repair could be considered a restoration, especially if the roof is returned to its original condition. Depending on the scale of the repair, the cost may need to be capitalized, particularly if a significant portion of the roof is being replaced.

Tax Implications of Capitalizing vs. Expensing Roof Repairs

The decision to capitalize or expense roof repair costs has significant tax implications, particularly for businesses.

Immediate Tax Deduction (Expensing)

Expensing allows you to deduct the entire cost of the repair in the year it was incurred. This can provide immediate tax relief by reducing your taxable income for that year. For smaller roof repairs, this is often the preferred method, as it reduces the immediate financial burden.

Depreciation (Capitalizing)

If the cost is capitalized, it must be depreciated over the useful life of the asset. For a new roof, this could mean spreading the cost out over 20 to 30 years, depending on the expected lifespan. While this reduces your taxable income more gradually, it also helps spread out the financial impact over a longer period.

Businesses should consult a tax professional to ensure they are making the best decision for their specific circumstances. The IRS has strict guidelines, and incorrectly categorizing expenses can lead to penalties or missed deductions.

Roof Repair Capitalize or Expense: Key Factors to Consider

Several factors should be taken into account when deciding whether to capitalize or expense a roof repair. These include:

1. Cost of the Repair

The larger the expense, the more likely it is that the cost should be capitalized. Minor repairs that fall below a certain threshold may be better suited for expensing.

2. Long-Term Value

If the repair significantly increases the value of your property or extends its useful life, it may be better to capitalize the cost. For example, a new roof can improve the energy efficiency and market value of the property.

3. Business vs. Residential

The rules for businesses and homeowners can vary. Businesses are often required to follow stricter accounting rules, while homeowners may have more flexibility. However, tax deductions for homeowners may still be limited, so it’s essential to understand the implications.

4. Consult with a Tax Professional

Given the complexity of IRS guidelines and tax laws, it’s always a good idea to consult with a tax professional or accountant before making any major decisions regarding roof repair capitalize or expense. A professional can provide tailored advice and ensure compliance with tax regulations.

Conclusion: Making the Right Decision for Your Roof Repairs

Deciding whether to capitalize or expense roof repair costs can have significant implications for both your tax situation and financial reporting. By understanding the difference between routine maintenance and significant improvements, and applying the IRS guidelines, you can make an informed decision that benefits your financial situation in the long term.

Whether you’re replacing a few shingles or installing an entirely new roof, knowing how to account for the costs can help you maximize your tax benefits while keeping your property in top condition. Always consider the scope of the work, the potential value it adds, and consult with a tax professional to ensure you’re making the right decision.

Leave a Reply