When it comes to maintaining a home, one of the most significant expenses can be roof replacement. Fortunately, homeowners may benefit from a Roof Replacement Tax Deduction, which can alleviate some of the financial burden. This article will explore what this deduction entails, how to qualify for it, and the best practices to maximize your tax benefits.

What is a Roof Replacement Tax Deduction?

The Roof Replacement Tax Deduction refers to the potential tax relief that homeowners can claim for the costs associated with replacing their roofs. While the specifics can vary depending on individual circumstances and local laws, this deduction can help offset some of the costs involved in maintaining or improving your property.

Why Consider Roof Replacement?

Before diving into the tax implications, it’s essential to understand why replacing a roof is often necessary:

- Damage Repair: Over time, roofs can suffer damage due to weather, age, and wear and tear.

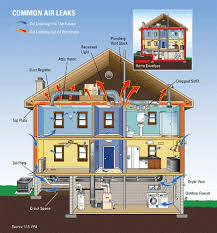

- Energy Efficiency: New roofing materials can improve your home’s energy efficiency, reducing heating and cooling costs.

- Increased Property Value: A new roof can enhance your home’s curb appeal and market value.

Read too: How To Replace Roof Shingles That Blew Off: A Comprehensive Guide

Types of Roof Replacement Tax Deductions

There are primarily two types of deductions related to roof replacement that homeowners may be eligible for:

- Capital Improvement Deduction: If your roof replacement significantly increases your home’s value, it may qualify as a capital improvement. In this case, you may be able to deduct the cost of the new roof when you sell your home, effectively reducing your taxable gain.

- Home Office Deduction: If you use part of your home for business, you may be able to deduct a portion of your roof replacement costs related to that space. This is particularly beneficial for those who work from home and maintain a dedicated office area.

How to Qualify for a Roof Replacement Tax Deduction

1. Determine Eligibility

To qualify for a roof replacement tax deduction, consider the following:

- Ownership: You must own the property where the roof replacement occurs.

- Type of Property: The property should be your primary residence or a qualifying rental property.

- Documentation: Keep detailed records of all expenses related to the roof replacement, including materials and labor costs.

2. Consult a Tax Professional

Tax laws can be complex and subject to change. Consulting a tax professional can provide personalized advice based on your specific situation. They can help you navigate the nuances of tax codes and ensure you maximize your deductions.

3. Record Keeping

Maintain thorough records of all transactions associated with your roof replacement. This includes:

- Invoices from contractors

- Receipts for materials purchased

- Any correspondence with tax authorities

Claiming the Roof Replacement Tax Deduction

Step-by-Step Process

- Gather Documentation: Collect all relevant receipts and invoices related to the roof replacement.

- Fill Out the Correct Forms: Depending on your situation, you may need to fill out specific tax forms such as Schedule A (for itemized deductions) or Schedule C (for business expenses).

- Consult IRS Guidelines: Review IRS publications related to home improvements and deductions to ensure compliance.

- Submit Your Tax Return: Include all deductions related to roof replacement when filing your tax return.

Common Mistakes to Avoid

- Not Keeping Records: Failure to maintain proper documentation can result in the inability to claim deductions.

- Misunderstanding Eligibility: Some homeowners assume they automatically qualify for deductions; understanding specific eligibility criteria is crucial.

- Overlooking State Taxes: Don’t forget to check state tax laws regarding deductions; they may differ from federal regulations.

Benefits of Roof Replacement Tax Deduction

Financial Relief

The most apparent benefit of claiming a roof replacement tax deduction is the potential financial relief it offers. Depending on your tax bracket, this deduction can result in substantial savings.

Improved Home Value

By replacing your roof and potentially deducting the costs, you enhance the overall value of your home, making it a more attractive option if you decide to sell in the future.

Energy Efficiency Savings

Investing in a new roof can lead to energy savings that complement your tax benefits. Many modern roofing materials offer better insulation, which can reduce heating and cooling costs.

When Roof Replacement Tax Deductions May Not Apply

While the Roof Replacement Tax Deduction can offer significant benefits, there are instances where it may not apply:

- If the Roof is Repaired, Not Replaced: Minor repairs typically do not qualify for deductions.

- Selling Within the Same Year: If you replace your roof and sell your home within the same tax year, you might not have enough time to capitalize on the deduction.

- Improper Documentation: If you fail to keep the necessary records, you may miss out on claiming the deduction.

Conclusion

The Roof Replacement Tax Deduction can provide valuable financial relief for homeowners facing the significant expense of a roof replacement. By understanding the eligibility criteria, maintaining proper documentation, and consulting with tax professionals, you can maximize your deductions and enhance the overall value of your property. Investing in a new roof not only protects your home but can also lead to tax benefits that make the financial commitment more manageable.

Leave a Reply