When it comes to insuring your home, one of the most critical factors that can impact your premiums and coverage is the type of roof you have. Different roof types for insurance purposes are assessed based on their durability, susceptibility to damage, and longevity, all of which influence how much you’ll pay in premiums and how well your home is protected in the event of an accident or natural disaster. Understanding the relationship between roof types and insurance coverage is essential for homeowners who want to maximize their protection while minimizing costs.

In this article, we will explore various roof types for insurance purposes, examine how each type is rated by insurance companies, and provide tips on how to ensure you’re getting the best coverage for your home.

Why Roof Type Matters for Insurance

Insurance companies factor in various aspects of your home when determining your premiums, and the roof is one of the most significant. The condition and type of roof directly affect your home’s risk profile because roofs play a crucial role in protecting the structure from environmental factors like rain, wind, hail, and extreme temperatures. Certain roof materials are more resistant to damage, which translates into fewer claims, lower risks for the insurer, and ultimately, lower premiums for you.

Homeowners with older, less durable roofs may face higher premiums or even difficulty obtaining coverage if the roof is considered too high-risk. By understanding the different roof types for insurance, you can make more informed decisions that may help you save money and protect your home better.

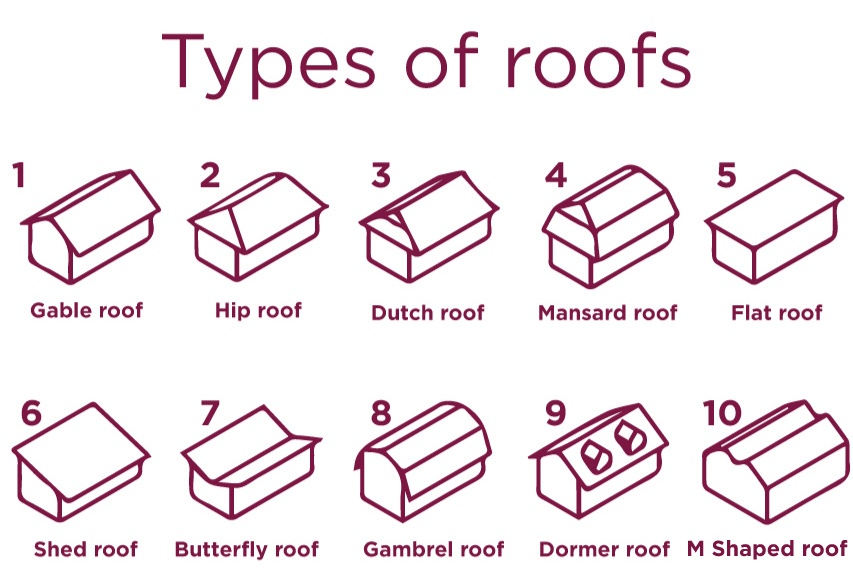

Common Roof Types and Their Impact on Insurance

Let’s take a closer look at some of the most common roof types and how they affect your insurance rates and coverage options.

Read too: Hail Damage Roof Repair: Essential Guide to Restoring Your Home’s Protection

1. Asphalt Shingles

Asphalt shingles are one of the most popular roofing materials in the U.S. due to their affordability and ease of installation. These shingles are made from fiberglass or organic materials and are coated with asphalt and granules for added durability.

Pros:

- Affordability: Asphalt shingles are cost-effective and widely available.

- Moderate durability: These shingles typically last between 20 and 30 years, providing reasonable longevity at a low cost.

- Easy to repair: If a section of your roof is damaged, replacing individual shingles is relatively simple.

Cons:

- Susceptible to weather damage: Asphalt shingles can be vulnerable to high winds, hail, and extreme weather conditions, which may result in higher insurance premiums, especially in areas prone to storms or hurricanes.

Impact on Insurance:

While asphalt shingles are widely accepted by insurance companies, homeowners in areas prone to severe weather may face higher premiums. Insurers may offer lower rates if your asphalt shingle roof is new or well-maintained, but older asphalt roofs may result in higher premiums due to increased risk of damage.

2. Metal Roofing

Metal roofing is becoming increasingly popular because of its durability, energy efficiency, and low maintenance. Made from materials like steel, aluminum, or copper, metal roofs are known for their ability to withstand extreme weather conditions.

Pros:

- Durability: Metal roofs can last 40 to 70 years, significantly longer than asphalt shingles.

- Weather resistance: Metal roofs are resistant to high winds, hail, and even fire, making them an excellent choice for homeowners in storm-prone areas.

- Energy-efficient: Metal roofs reflect heat, helping to reduce cooling costs in hot climates.

Cons:

- Higher upfront cost: While metal roofs are durable, they are also more expensive to install than asphalt shingles.

- Noise: Metal roofs can be noisy during heavy rain or hailstorms unless adequate insulation is installed.

Impact on Insurance:

Insurance companies tend to favor metal roofs because of their durability and resistance to damage. Homeowners with metal roofs may enjoy lower premiums due to the reduced risk of weather-related claims. In some cases, insurers may even offer discounts for homes with metal roofing because of its long lifespan and protective properties.

3. Tile Roofing (Clay or Concrete)

Tile roofing is commonly found in Mediterranean, Spanish, or Southwestern-style homes. These roofs are made from either clay or concrete tiles, which are known for their longevity and distinctive appearance.

Pros:

- Longevity: Tile roofs can last over 50 years with proper maintenance.

- Weather resistance: Clay and concrete tiles are highly resistant to fire, rot, and insects, and they hold up well in hot climates.

- Aesthetic appeal: Tile roofs provide a unique, upscale look that enhances a home’s curb appeal.

Cons:

- Weight: Tile roofs are heavy, and not all homes are structurally equipped to support them.

- Cost: The upfront cost of a tile roof is high, and installation can be labor-intensive.

- Fragility: While durable in the face of weather, tiles can break if walked on, making repairs tricky.

Impact on Insurance:

Because tile roofs are highly durable and resistant to fire and weather damage, many insurance companies consider them lower risk. Homeowners with tile roofs may qualify for reduced premiums, especially in areas prone to wildfires. However, the high cost of repairs and replacement may factor into higher premiums if the roof is damaged.

4. Slate Roofing

Slate roofs are made from natural stone and are one of the most durable roofing options available. Known for their elegance and long lifespan, slate roofs are commonly found on historic homes and high-end properties.

Pros:

- Extreme durability: Slate roofs can last over 100 years with minimal maintenance.

- Fire and weather resistance: Slate is naturally fireproof and can withstand harsh weather conditions.

- Eco-friendly: Since slate is a natural material, it’s a sustainable roofing option.

Cons:

- High cost: Slate is one of the most expensive roofing materials to install.

- Weight: Like tile, slate is heavy and requires a strong structural foundation to support it.

- Difficult repairs: Replacing slate tiles can be costly and requires skilled labor.

Impact on Insurance:

Insurance companies often provide favorable rates for homes with slate roofs due to their longevity and resistance to damage. However, the high cost of repairing or replacing a slate roof could mean higher premiums, as insurers factor in potential repair costs.

5. Wood Shake Roofing

Wood shake roofs, often made from cedar, provide a rustic, natural appearance that many homeowners find appealing. However, these roofs come with certain risks that can affect insurance rates.

Pros:

- Aesthetic appeal: Wood shakes give homes a classic, rustic look that enhances curb appeal.

- Insulation properties: Wood shakes offer good insulation, helping to maintain stable indoor temperatures.

Cons:

- Fire hazard: Wood shakes are highly flammable, making them a risky choice in areas prone to wildfires.

- Weather susceptibility: Wood roofs can be vulnerable to rot, mold, and insect damage if not properly maintained.

- Shorter lifespan: Wood shakes typically last 20 to 30 years, which is less than other roofing materials like metal or tile.

Impact on Insurance:

Due to their fire risk and susceptibility to weather damage, homeowners with wood shake roofs may face higher insurance premiums. In areas prone to wildfires, some insurers may not cover wood shake roofs at all, or they may require homeowners to treat the wood with fire-resistant chemicals.

Roof Types for Insurance: How to Choose the Best Option

When selecting the best roof types for insurance purposes, it’s important to weigh the initial cost, durability, and long-term benefits. Here are some tips to help you make the best decision for your home:

1. Consider Your Climate

Different roofing materials perform better in certain climates. For example, metal roofs are ideal for areas prone to storms or wildfires, while tile or slate roofs are excellent choices for hot, dry climates.

2. Think About Longevity

A roof is a significant investment, and choosing a durable material can save you money in the long run. Materials like metal, tile, and slate offer long lifespans and are often favored by insurance companies due to their durability.

3. Research Local Building Codes

Some areas have specific building codes regarding roofing materials, especially in regions prone to wildfires or hurricanes. Make sure the roof you choose complies with local regulations, as this can affect your insurance coverage.

4. Ask Your Insurance Provider

Before making a final decision, it’s a good idea to consult your insurance provider. Ask them about which roofing materials may lower your premiums or qualify you for discounts. They may also provide advice on how to maintain your roof to ensure it remains insurable over time.

Conclusion

Choosing the right roof types for insurance purposes can have a significant impact on your home insurance premiums and coverage. Each roofing material comes with its own set of advantages and disadvantages, but factors like durability, weather resistance, and fire safety will play a large role in determining your rates. By considering your climate, budget, and insurance needs, you can select a roofing material that not only protects your home but also keeps your premiums manageable.

Leave a Reply