Metal roofs are becoming an increasingly popular choice for homeowners due to their durability and longevity. They offer excellent protection against the elements and can withstand severe weather conditions. However, like any roofing system, metal roofs are not immune to damage. When it comes to potential roof repairs or replacements, homeowners often wonder, “Does insurance cover metal roofs?” In this article, we’ll explore the factors that determine whether insurance covers metal roofs and what you should know as a homeowner.

Understanding Homeowners Insurance

Coverage Types

Homeowners insurance typically includes several types of coverage:

- Dwelling Coverage: This covers damage to the structure of your home, including the roof.

- Other Structures Coverage: This applies to structures on your property, such as detached garages or sheds.

- Personal Property Coverage: This covers your personal belongings inside your home.

- Liability Coverage: This provides protection in case someone is injured on your property.

- Additional Living Expenses Coverage: If your home becomes uninhabitable, this coverage can help with temporary living expenses.

Factors That Influence Coverage

Whether your homeowners insurance covers your metal roof depends on several factors:

1. Cause of Damage

Homeowners insurance typically covers damage caused by specific perils, such as:

- Fire

- Wind

- Hail

- Falling Objects

- Vandalism

- Theft

If the damage to your metal roof is a result of one of these covered perils, your insurance may apply.

2. Maintenance and Neglect

Homeowners insurance is not intended to cover damage that results from a lack of maintenance or neglect. If your metal roof is damaged because of poor maintenance or an existing issue, it may not be covered.

3. Age of the Roof

The age of your metal roof can also influence coverage. Some insurance policies have restrictions on coverage for roofs that are beyond a certain age, typically 20 to 25 years.

4. Policy Specifics

Every homeowners insurance policy is different, and the specifics of your policy will dictate what is covered and under what circumstances.

When Does Insurance Cover Metal Roofs?

To determine whether your metal roof is covered by insurance, consider the following scenarios:

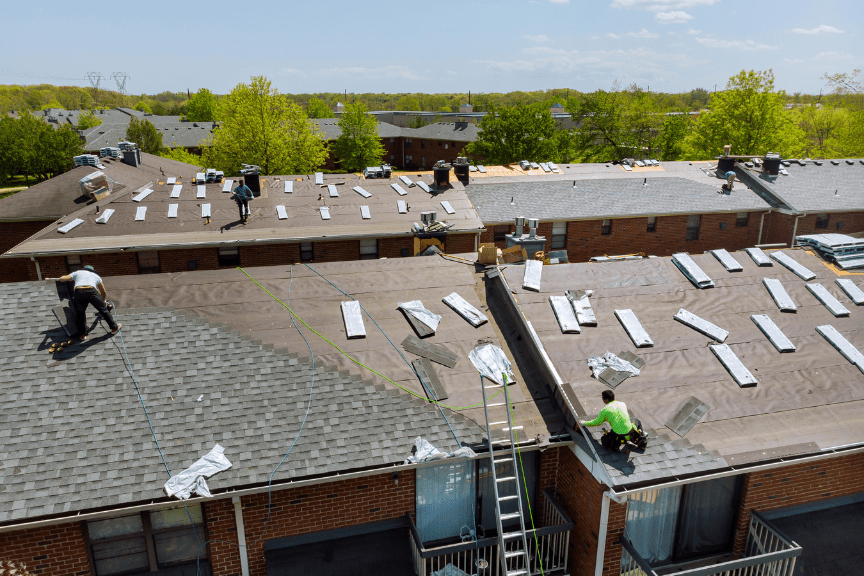

1. Storm Damage

If your metal roof sustains damage due to a covered peril, such as a severe storm, hail, or a falling tree, your homeowners insurance will typically cover the cost of repairs or replacement. Be sure to document the damage with photos and contact your insurance company promptly to initiate the claims process.

2. Accidental Damage

Accidental damage, such as a satellite dish falling onto the roof or a contractor causing damage during a repair, is generally covered by homeowners insurance. Again, it’s crucial to report the incident and provide documentation.

When Does Insurance Not Cover Metal Roofs?

Your insurance may not cover your metal roof in the following situations:

1. Lack of Maintenance

If your roof is damaged due to a lack of maintenance, neglect, or wear and tear, it’s unlikely to be covered. Insurance intends to address unexpected and suddenly occurring damage, not issues that regular maintenance could have prevented.

2. Excluded Perils

Some insurance policies exclude specific perils, such as earthquakes or floods. If an excluded peril damages your metal roof, you won’t be able to claim the repairs.

3. Roof Age

If your metal roof is beyond a certain age, typically 20 to 25 years, it may not be covered for replacement in the event of damage. Insurance companies often have restrictions on coverage for older roofs due to the increased risk of wear and tear.

Conclusion

Whether or not insurance covers metal roofs depends on various factors, including the cause of damage, the age of the roof, and the specifics of your homeowners insurance policy. To ensure appropriate coverage, review your policy, understand its terms, and regularly maintain your metal roof to prevent issues that your policy may not cover. In the event of damage, promptly document the situation and contact your insurance company to begin the claims process, ensuring your investment in a metal roof continues to provide protection for your home.

Leave a Reply