When it comes to safeguarding your home in Florida, combining a durable metal roof with the right homeowners insurance is an intelligent decision. Metal roofs offer unparalleled durability and resilience, which is particularly valuable in a state prone to hurricanes, heavy rain, and intense heat. Understanding how your roof type affects your insurance can help you make informed decisions that protect both your property and your finances.

This comprehensive guide explores everything you need to know about Florida homeowners insurance and metal roofs, including the benefits of metal roofing, how it impacts insurance premiums, and tips for securing the best coverage.

Why Choose a Metal Roof for Your Florida Home?

Durability Against Extreme Weather

Florida experiences some of the harshest weather conditions in the U.S. From hurricanes to intense UV rays, a metal roof provides a sturdy defense against these elements. Its resistance to high winds and water damage makes it a reliable option for homeowners.

Read too: How Long aDo Standing Seam Metal Roofs Last? A Comprehensive Guide to Durability and Longevity

Energy Efficiency

Metal roofs reflect sunlight, reducing heat absorption and lowering cooling costs. This is especially valuable in Florida’s hot and humid climate.

Longevity

Unlike asphalt shingles, which typically last 20–30 years, metal roofs can last 50 years or more with proper maintenance.

Environmentally Friendly

Metal roofing materials are often made from recycled content and can be recycled again at the end of their life, making them a sustainable choice.

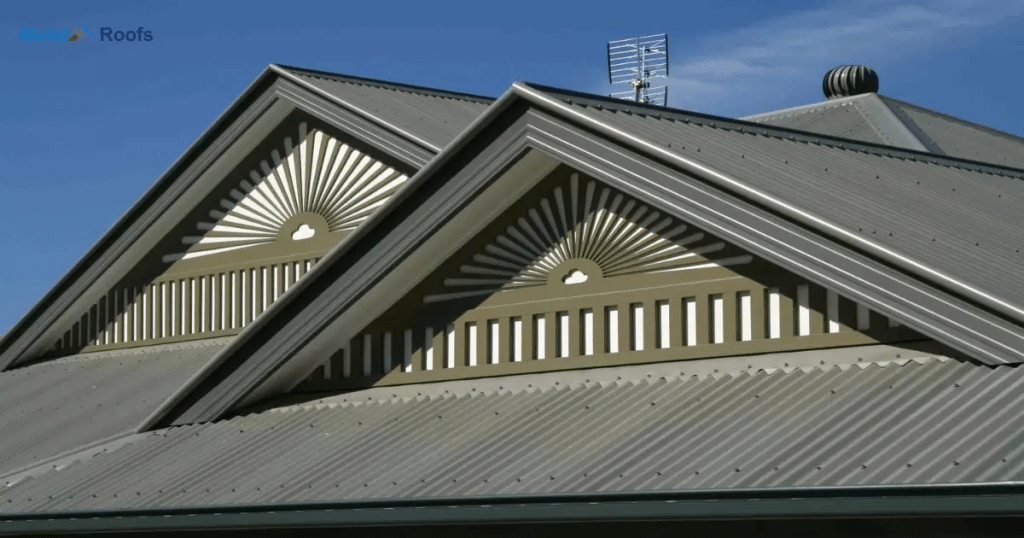

Aesthetic Appeal

Metal roofs are available in various styles and colors, enhancing the curb appeal of your home while offering robust protection.

How Florida Homeowners Insurance Covers Metal Roofs

Lower Insurance Premiums for Metal Roofs

In many cases, having a metal roof can lead to reduced insurance premiums. Insurance companies recognize the superior durability of metal roofs, especially their ability to withstand hurricane-force winds and resist fire.

Hurricane Mitigation Credits

Florida insurance companies often provide discounts for homes with wind-resistant features. Metal roofs, which are less likely to suffer damage during a storm, may qualify for these credits.

Coverage for Metal Roof Replacement

Homeowners insurance typically covers roof replacement if damage occurs due to a covered peril, such as a hurricane or hailstorm. It’s essential to review your policy to ensure your metal roof is fully protected.

Exclusions and Maintenance Clauses

Some policies may have exclusions for certain types of damage or require regular maintenance to keep coverage active. Always check the fine print to avoid surprises.

Understanding the Cost of Florida Homeowners Insurance with a Metal Roof

While metal roofs can reduce insurance premiums, the extent of the savings depends on several factors:

Age of the Roof

Newer metal roofs are more likely to qualify for discounts. Older roofs, even metal ones, may require inspections or upgrades to meet insurance standards.

Type of Metal Roofing Material

High-quality materials, such as standing seam panels, may offer greater discounts than corrugated metal or lower-grade options.

Roof Installation Standards

Insurance providers often require roofs to be installed according to Florida Building Code standards. Ensuring proper installation can maximize your savings.

Location and Risk Factors

If you live in a high-risk area for hurricanes or flooding, your premiums may still be higher despite having a metal roof.

Florida Homeowners Insurance Metal Roof: Benefits for Hurricane Season

Resistance to Wind Damage

Metal roofs are tested to withstand winds of up to 140 mph or more, making them an ideal choice for Florida’s hurricane-prone regions.

Protection Against Water Intrusion

Properly installed metal roofs are less likely to develop leaks, reducing the risk of water damage during heavy rain.

Fire Resistance

Metal roofs have a Class A fire rating, offering the highest level of protection. This can be especially important in areas prone to wildfires.

Peace of Mind

Knowing your roof can withstand the elements during a storm provides invaluable peace of mind for Florida homeowners.

How to Choose the Best Metal Roof for Insurance Benefits

1. Select Quality Materials

Opt for materials with high durability, such as aluminum or steel. Look for certifications that indicate compliance with Florida Building Codes.

2. Work with Licensed Contractors

Ensure your roof is installed by licensed professionals experienced in metal roofing. Improper installation can void your insurance discounts.

3. Invest in Hurricane Straps

Adding hurricane straps or clips during installation can enhance the roof’s wind resistance, potentially qualifying for additional insurance savings.

4. Schedule Regular Inspections

Routine inspections can help identify potential issues before they escalate, ensuring your roof remains eligible for insurance benefits.

Tips for Saving on Florida Homeowners Insurance

1. Bundle Policies

Combining homeowners insurance with other policies, such as auto insurance, can lead to significant discounts.

2. Raise Your Deductible

A higher deductible can lower your premiums, but be sure you can afford the out-of-pocket costs in the event of a claim.

3. Install Impact-Resistant Features

In addition to a metal roof, consider impact-resistant windows and doors to further reduce premiums.

4. Shop Around

Get quotes from multiple insurers to find the best coverage and rates for your metal-roofed home.

5. Ask About Discounts

Don’t hesitate to ask your insurance provider about available discounts for having a metal roof or other wind-resistant features.

Common Questions

Q: Does homeowners insurance cover metal roof damage?

Yes, homeowners insurance typically covers damage caused by covered perils, such as hurricanes, hail, or fire. However, exclusions may apply for wear and tear or lack of maintenance.

Q: Can a metal roof reduce my insurance premiums?

In many cases, yes. Metal roofs are highly durable and resistant to damage, which insurance providers often reward with lower premiums.

Q: How often should I inspect my metal roof?

It’s recommended to inspect your roof annually and after major storms to ensure it remains in good condition.

Q: Are there additional costs for insuring a metal roof?

While the initial cost of installing a metal roof may be higher, the long-term savings on insurance and maintenance can offset the expense.

The Bottom Line

Investing in a metal roof for your Florida home offers a host of benefits, from enhanced durability to potential insurance savings. By understanding how your roofing choice impacts your insurance policy, you can make informed decisions that protect your property and reduce costs.

Whether you’re upgrading your existing roof or planning a new installation, combining a metal roof with the right Florida homeowners insurance ensures your home is well-protected against the Sunshine State’s unique challenges.

Take the time to consult with roofing professionals and insurance agents to maximize the value of your investment. With a metal roof, you’ll enjoy peace of mind, energy efficiency, and potentially lower premiums—making it a smart choice for any Florida homeowner.

Leave a Reply