Discovering water dripping from your ceiling is stressful—and expensive. Many homeowners aren’t sure whether insurance covers the damage or how to start the process. If you’re searching for How To Claim On House Insurance For Leaking Roof, this complete guide will walk you through every step so you can file confidently and avoid costly mistakes.

Roof leaks can qualify for coverage—but only under specific conditions. Understanding those conditions is key.

How To Claim On House Insurance For Leaking Roof Successfully

Filing a claim isn’t just about calling your insurance company. It’s about documenting damage, understanding coverage rules, and following proper procedure.

Read too: How To Replace Roof Shingles That Blew Off: A Comprehensive Guide

Home insurance policies generally fall under the broader category of Wikipedia, which outlines coverage for sudden and accidental damage—but often excludes gradual wear and tear.

Let’s break down the process.

Does Home Insurance Cover a Leaking Roof?

This is the most common question.

Covered Situations (Typically)

Insurance may cover roof leaks caused by:

- Storm damage (wind, hail)

- Falling trees

- Sudden accidental events

- Fire damage

Usually Not Covered

- Wear and tear

- Neglected maintenance

- Old age deterioration

- Gradual leaks over time

Insurance covers sudden, unexpected damage, not long-term neglect.

Step 1: Stop Further Damage Immediately

Before filing a claim, you must prevent additional damage.

Actions to Take

- Place buckets under leaks.

- Move furniture away from water.

- Cover roof with tarp if safe to do so.

- Take photos before making temporary repairs.

Most policies require homeowners to mitigate further damage.

Step 2: Document Everything

Proper documentation strengthens your claim.

Take Photos Of:

- Damaged shingles

- Interior ceiling stains

- Insulation damage

- Structural wood damage

- Storm debris

Record:

- Date damage occurred

- Weather conditions

- Visible exterior damage

The more detailed your documentation, the smoother the claim process.

Step 3: Review Your Insurance Policy

Before calling your insurer:

- Check deductible amount

- Confirm coverage limits

- Verify exclusions

If your deductible is $1,500 and repairs cost $1,800, filing may not be worthwhile.

Step 4: Contact Your Insurance Company

Report the claim promptly.

When speaking with the representative:

- Provide policy number

- Describe damage clearly

- State cause (if known)

- Submit photos if requested

You will receive a claim number for tracking.

Step 5: Schedule Adjuster Inspection

An insurance adjuster will inspect the damage.

During Inspection:

- Show all affected areas

- Provide documentation

- Share contractor estimates (if available)

Adjusters evaluate:

- Cause of damage

- Extent of roof damage

- Repair vs replacement necessity

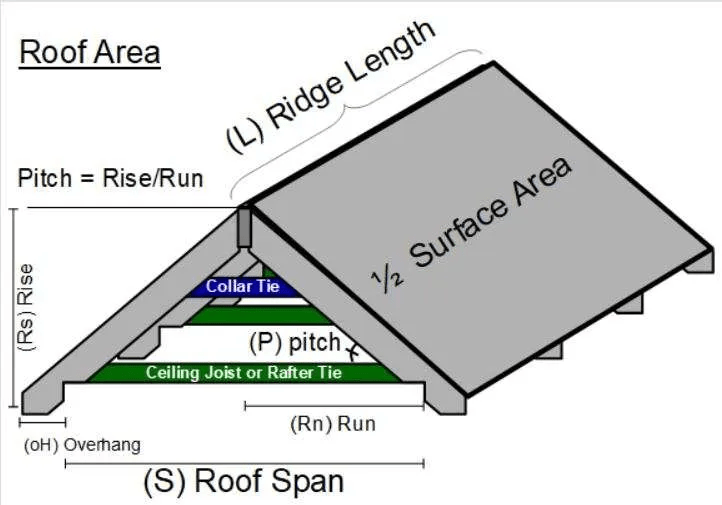

Step 6: Obtain Roofing Contractor Estimates

It’s wise to get at least 2–3 licensed contractor quotes.

Ensure contractors include:

- Roof area measurement

- Material type

- Labor cost

- Tear-off cost

- Permit fees

Providing written estimates strengthens negotiation.

Step 7: Review Settlement Offer

Insurance companies calculate payout based on:

- Actual Cash Value (ACV) or

- Replacement Cost Value (RCV)

ACV

Payout minus depreciation.

RCV

Pays full replacement cost (minus deductible), often after work completion.

Example Claim Breakdown

Roof replacement estimate: $12,000

Deductible: $1,500

Insurance payout = $10,500 (if RCV coverage applies)

If ACV applies, depreciation reduces payout.

When Claims Get Denied

Common reasons for denial:

- Pre-existing damage

- Lack of maintenance

- Insufficient documentation

- Leak classified as gradual deterioration

If denied, you can:

- Request detailed explanation

- Provide additional documentation

- Hire public adjuster

How Long Does a Roof Insurance Claim Take?

Average timeline:

- 1–3 days: Report claim

- 7–14 days: Adjuster inspection

- 2–4 weeks: Settlement decision

Complex claims may take longer.

Pros and Cons of Filing a Claim

Advantages

- Reduces out-of-pocket expenses

- Covers major storm damage

- Protects home value

Disadvantages

- Possible premium increase

- Deductible costs

- Risk of claim denial

When Should You Avoid Filing a Claim?

Avoid filing if:

- Damage cost is below deductible

- Leak caused by aging shingles

- Repair cost is minor

Frequent claims can affect future premiums.

Tips to Increase Claim Approval Chances

- File promptly after damage

- Provide clear weather evidence

- Keep maintenance records

- Avoid permanent repairs before inspection

- Work with licensed contractors

Preparation increases approval probability.

What If the Leak Causes Interior Damage?

Insurance typically covers:

- Ceiling repair

- Insulation replacement

- Drywall repair

- Mold remediation (if immediate)

Delayed reporting may reduce coverage.

How Insurance Companies Determine Roof Age

Insurers often:

- Review prior inspection reports

- Request installation documentation

- Check permit records

Older roofs may receive partial payout due to depreciation.

FAQ: How To Claim On House Insurance For Leaking Roof

1. Will my premium increase if I file a claim?

Possibly. It depends on claim frequency and insurer policies.

2. Does insurance cover mold from roof leaks?

If mold results from sudden covered damage and reported promptly, usually yes.

3. Can I choose my own contractor?

Yes. You are not required to use the insurer’s preferred contractor.

4. What if the adjuster underestimates damage?

You can request reinspection or hire a public adjuster.

5. Is hail damage automatically covered?

If hail caused sudden roof damage, most policies cover it.

6. How much does deductible affect payout?

Your deductible is subtracted from approved settlement.

Preventative Tips to Avoid Future Roof Claims

- Inspect roof annually

- Clean gutters twice yearly

- Replace damaged shingles immediately

- Document roof condition after storms

Routine maintenance reduces claim disputes.

Final Thoughts

Understanding How To Claim On House Insurance For Leaking Roof empowers you to act quickly and strategically during a stressful situation. By documenting damage, reviewing your policy, and communicating clearly with your insurer, you improve your chances of claim approval and fair compensation.

If this guide helped you navigate the roof insurance process, consider sharing it on social media to help other homeowners protect their homes and finances.

Leave a Reply