Replacing a roof is a significant investment, and it’s essential to explore any potential financial benefits that can help reduce the cost. One such benefit is the tax credit for replacing a roof. In this comprehensive guide, we’ll delve into what tax credits are available for roof replacements, how to qualify, and the steps to apply. Whether you’re considering a roof replacement or have already completed the project, understanding these credits can provide valuable savings.

What is a Tax Credit for Replacing a Roof?

A tax credit for replacing a roof can significantly reduce the cost of your roofing project by lowering your overall tax liability. Tax credits directly reduce the amount of tax you owe, unlike deductions, which reduce your taxable income. For roof replacements, this means you could receive a dollar-for-dollar reduction in your tax bill based on the amount of the credit.

Types of Tax Credits Available

1. Federal Tax Credits

Historically, the federal government has offered tax credits for energy-efficient home improvements, including roof replacements. These credits are part of the Residential Energy Efficiency Property Credit and are designed to encourage homeowners to invest in energy-saving improvements.

2. State and Local Tax Credits

In addition to federal credits, many states and local governments offer their own tax incentives for home improvements. These can vary widely depending on your location and the specific programs available.

Read too: How To Replace Roof Shingles That Blew Off: A Comprehensive Guide

Eligibility for Tax Credit for Replacing Roof

To qualify for a tax credit for replacing a roof, certain conditions must be met. Here’s a breakdown of the typical eligibility requirements:

1. Type of Roof

Energy-Efficient Roofing

To qualify for a tax credit, the new roof must meet specific energy efficiency standards. This often means that the roofing material should be designed to reflect more sunlight and absorb less heat, thereby improving your home’s energy efficiency. Examples include reflective metal roofing and certain types of shingles with energy-efficient coatings.

2. Certification and Documentation

Manufacturer Specifications

The roofing materials must come from manufacturers who provide certification that their products meet the required energy efficiency standards. It’s important to obtain and keep these certifications for tax filing purposes.

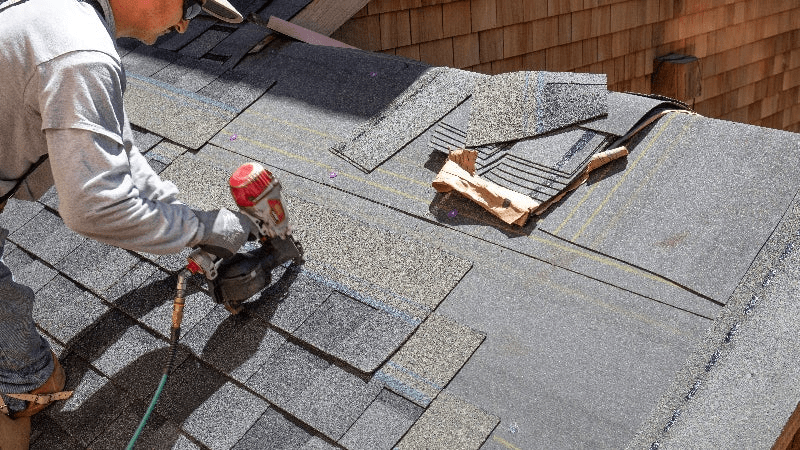

Professional Installation

In some cases, the installation of the roof may need to be performed by a certified professional to qualify for the credit. Check with the specific tax credit program for detailed requirements.

3. Application Process

Tax Forms and Documentation

To claim the tax credit, you will need to complete specific tax forms. For federal credits, this usually involves filling out IRS Form 5695, which is used to report residential energy credits. You will need to include documentation of the roofing materials and installation, such as receipts and certification forms.

Record Keeping

Maintain detailed records of your roofing project, including invoices, contracts, and proof of payment. These documents will be necessary when claiming the tax credit and in case of an audit.

Benefits of Claiming a Tax Credit for Roof Replacement

1. Financial Savings

The primary benefit of claiming a tax credit for roof replacement is the reduction in your tax liability, which can result in substantial financial savings. Depending on the amount of the credit and your tax situation, this can significantly lower the cost of your roofing project.

2. Increased Home Value

Upgrading to an energy-efficient roof can also increase your home’s value. Prospective buyers often look for homes with energy-saving features, and a new, efficient roof can make your property more attractive.

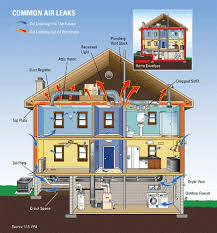

3. Enhanced Energy Efficiency

An energy-efficient roof can lower your utility bills by improving your home’s insulation and reducing heat absorption. This not only saves money but also contributes to a more sustainable lifestyle.

How to Maximize Your Tax Credit for Roof Replacement

1. Research Available Credits

Start by researching both federal and state/local tax credits for which you may be eligible. Check the IRS website for federal credits and visit your state or local government’s website for additional programs.

2. Choose Energy-Efficient Materials

Select roofing materials that meet or exceed the energy efficiency requirements for tax credits. Look for products with high solar reflectance and thermal emittance ratings.

3. Work with Certified Professionals

Ensure that your roofing contractor is familiar with the requirements for claiming tax credits. They should be able to provide you with the necessary documentation and ensure that the installation meets the required standards.

4. Keep Detailed Records

Maintain thorough records of your roofing project, including all receipts, certifications, and installation details. This documentation will be crucial when filing for the tax credit and during any potential audits.

Common Questions About Tax Credits for Roof Replacement

1. How Much Can I Save with a Tax Credit for Roof Replacement?

The amount you can save depends on the specific credit program and the cost of your roofing project. Federal tax credits typically cover a percentage of the total cost, while state and local credits can vary.

2. Are Tax Credits Available for Roof Repairs or Only Replacements?

Tax credits are generally available for full roof replacements rather than repairs. However, some programs might offer incentives for certain types of repairs if they include energy-efficient upgrades.

3. Can I Combine Tax Credits with Other Incentives?

In many cases, you can combine tax credits with other incentives, such as utility rebates or financing programs. Check with the relevant agencies and programs to understand how they interact.

4. What Happens If I Miss the Deadline for Claiming a Tax Credit?

Tax credits must be claimed in the tax year in which the roofing project was completed. If you miss the deadline, you may not be able to claim the credit for that year, so it’s essential to ensure all documentation is submitted on time.

Conclusion

Claiming a tax credit for replacing a roof can provide significant financial benefits and support your investment in an energy-efficient upgrade. By understanding the eligibility requirements, selecting the right materials, and keeping detailed records, you can maximize your savings and enhance the value and efficiency of your home.

Whether you’re planning a roof replacement or have already completed the project, exploring available tax credits is a crucial step in managing your overall expenses. Consult with a tax professional to ensure you’re taking full advantage of any credits and incentives for which you qualify.

Leave a Reply