Seeing a dip or depression in your roof can be stressful, especially if you’re still paying a mortgage. Many homeowners ask, Will My Lender Insurance Pay Dip In Roof Of House? The answer depends on what caused the dip, how your insurance policy is structured, and whether the damage is considered sudden or gradual.

This guide explains everything in clear, simple terms—so you know what to expect before calling your lender or filing a claim.

What Does “Lender Insurance” Actually Mean?

Before answering whether lender insurance will pay for a dip in your roof, it’s important to clarify the term.

Read too: How Long Do Standing Seam Metal Roofs Last? A Comprehensive Guide to Durability and Longevity

Lender Insurance vs Homeowners Insurance

- Lender-placed insurance (also called force-placed insurance) is purchased by your mortgage lender if you fail to maintain homeowners insurance.

- Standard homeowners insurance is purchased by you and typically offers broader protection.

Lender-placed insurance mainly protects the lender’s financial interest, not the homeowner’s comfort or full repair costs.

Will My Lender Insurance Pay Dip In Roof Of House?

In most cases, lender insurance will not pay for a dip in your roof unless it was caused by a sudden, covered event.

Covered events may include:

- Severe windstorms

- Heavy snow causing sudden structural failure

- Fallen trees or debris impact

However, gradual damage, poor construction, aging materials, or long-term structural settling are usually excluded.

Common Causes of a Dip in a Roof (And Coverage Likelihood)

| Cause of Roof Dip | Covered by Lender Insurance? |

|---|---|

| Storm or wind damage | ✅ Sometimes |

| Heavy snow load | ⚠️ Case-dependent |

| Poor construction | ❌ No |

| Aging materials | ❌ No |

| Water damage over time | ❌ No |

| Foundation settling | ❌ No |

Key takeaway: Insurance focuses on sudden and accidental damage, not long-term deterioration.

Why Roof Dips Are Often Denied by Insurance

Insurance policies—especially lender-placed ones—are written to limit risk. Roof dips are commonly denied because they are considered:

- Maintenance issues

- Structural wear and tear

- Pre-existing conditions

According to general insurance principles outlined on

👉 https://www.wikipedia.org/wiki/Home_insurance

“Insurance is designed to cover unexpected losses, not inevitable deterioration.”

How Inspectors Determine the Cause of a Roof Dip

Insurance adjusters and inspectors look for:

- Cracked or broken rafters

- Water stains on ceiling joists

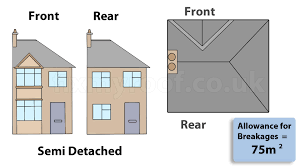

- Uneven rooflines visible from the exterior

- Signs of long-term moisture exposure

If evidence suggests the dip developed slowly, coverage is unlikely.

Lender Insurance vs Homeowners Insurance: Coverage Comparison

| Feature | Lender Insurance | Homeowners Insurance |

|---|---|---|

| Protects homeowner | ❌ Limited | ✅ Yes |

| Covers gradual damage | ❌ No | ❌ No |

| Covers sudden roof damage | ⚠️ Limited | ✅ Often |

| Cost | High | Moderate |

| Control over policy | Lender | Homeowner |

If you rely solely on lender insurance, your protection is significantly reduced.

Step-by-Step: What To Do If You Notice a Dip in Your Roof

1. Document the Damage

Take clear photos from inside and outside the home.

2. Review Your Insurance Policy

Look specifically for exclusions related to:

- Structural defects

- Wear and tear

- Water intrusion

3. Schedule a Professional Roof Inspection

A licensed contractor can determine whether damage is sudden or long-term.

4. Notify Your Lender

If lender insurance is involved, reporting is usually required immediately.

5. File a Claim (If Applicable)

Include inspection reports and timelines showing when damage likely occurred.

Can You Appeal a Denied Lender Insurance Claim?

Yes—but success is limited.

To appeal, you’ll need:

- Independent structural engineer report

- Evidence of a specific triggering event (storm date, weather report)

- Proof damage was not pre-existing

Even then, lender insurance providers deny most structural claims.

Real-World Case Example

A homeowner in Ohio noticed a roof dip after a record snowfall. The insurer initially denied the claim, citing long-term structural weakness. After submitting:

- Weather data confirming extreme snowfall

- Engineer documentation showing sudden truss failure

The claim was partially approved, covering only structural stabilization—not cosmetic repairs.

Preventing Roof Dips Before Insurance Is an Issue

Proactive Maintenance Tips

- Inspect attic framing annually

- Repair minor leaks immediately

- Remove excessive snow buildup safely

- Reinforce older roof structures

Preventive care costs far less than uncovered structural repairs.

Frequently Asked Questions (FAQ)

Does lender insurance cover structural roof damage?

Only if caused by a sudden, covered event—and even then, coverage is limited.

Is a roof dip considered a cosmetic issue?

No. It’s structural—but that doesn’t guarantee insurance coverage.

Can I switch from lender insurance to homeowners insurance?

Yes. In fact, it’s strongly recommended for better protection and lower cost.

Will insurance cover repairs required by a home inspector?

Not usually. Inspection findings are not considered sudden damage.

How much does it cost to fix a roof dip?

Repairs typically range from $1,500 to $7,000, depending on severity.

Conclusion

So, will my lender insurance pay dip in roof of house?

In most situations, no—unless you can clearly prove the damage was sudden and accidental. Lender insurance is designed to protect the mortgage company, not fully restore your home.

Understanding your coverage, acting quickly, and maintaining your roof are the best ways to avoid costly surprises. If this article helped you, share it on social media to help other homeowners protect their investment.

Leave a Reply