When homeowners face the prospect of a roof replacement, one pressing question often arises: Is A Roof Replacement Tax Deductible? Understanding the tax implications can make a significant difference in financial planning and decision-making.

Exploring the Question: Is A Roof Replacement Tax Deductible?

For many homeowners, the deductibility of a roof replacement depends on several factors. The IRS guidelines provide clarity on what qualifies as a deductible expense and under what circumstances homeowners can benefit from tax deductions related to home improvements.

Understanding Tax Deductibility Criteria

The deductibility of a roof replacement primarily hinges on whether the replacement is classified as a repair or an improvement. According to IRS regulations:

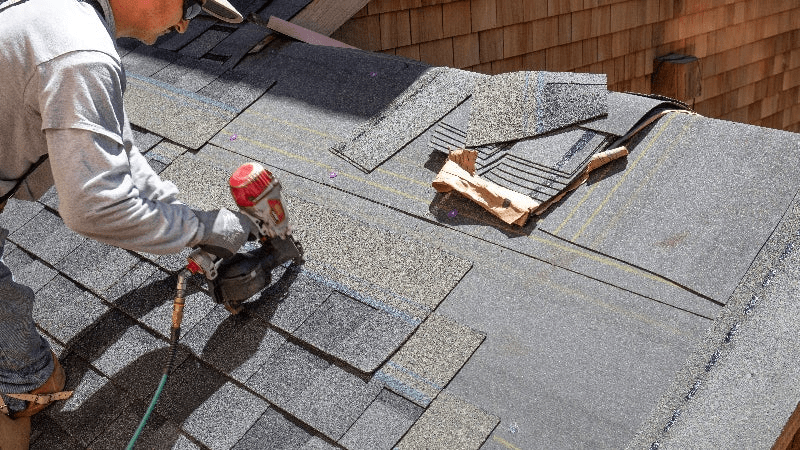

- Repairs: Expenses incurred for repairing a roof, such as fixing leaks or replacing damaged shingles, are typically deductible as maintenance expenses.

- Improvements: Costs associated with improving the property, such as installing a new roof to upgrade from a basic material to a more durable one, may not be fully deductible immediately but could be depreciated over time.

Read too: How To Replace Roof Shingles That Blew Off: A Comprehensive Guide

Documenting Expenses

To claim a deduction for a roof replacement, it’s crucial to maintain detailed records of all expenses incurred. This includes invoices, receipts, and any documentation that clearly outlines the nature of the work performed and the materials used.

Tax Credits vs. Deductions

While a tax deduction reduces your taxable income, thereby potentially lowering your overall tax liability, tax credits provide a dollar-for-dollar reduction in the amount of tax owed. Some energy-efficient roof installations may qualify for tax credits under specific circumstances, promoting environmentally friendly upgrades.

Consultation with Tax Professionals

Given the complexities of tax laws and regulations surrounding home improvements, homeowners are encouraged to consult with tax professionals or certified public accountants (CPAs) to determine eligibility for deductions or credits related to a roof replacement. These professionals can provide personalized advice based on individual circumstances.

State-Specific Considerations

In addition to federal tax considerations, homeowners should also be aware of any state-specific tax incentives or deductions that may apply to roof replacements. Some states offer additional benefits or credits for energy-efficient upgrades or home renovations aimed at enhancing property value.

Financial Planning and Budgeting

Understanding the tax implications of a roof replacement allows homeowners to factor these costs into their financial planning and budgeting strategies. Whether it’s exploring deductible expenses or potential credits, proactive planning can help minimize tax burdens associated with home maintenance and improvements.

Conclusion

While the question “Is A Roof Replacement Tax Deductible” doesn’t always have a straightforward answer, homeowners can navigate the complexities by staying informed and seeking professional guidance when necessary. By understanding IRS guidelines, documenting expenses diligently, and exploring available tax credits, homeowners can make informed decisions regarding their roof replacement projects.

Leave a Reply