When considering a metal roof for your home, one crucial question often arises: “Do insurance companies cover metal roofs?” This article aims to delve into the details of how insurance coverage works for metal roofs, the benefits they offer, and what you need to know to make informed decisions regarding your home insurance policy.

What is a Metal Roof?

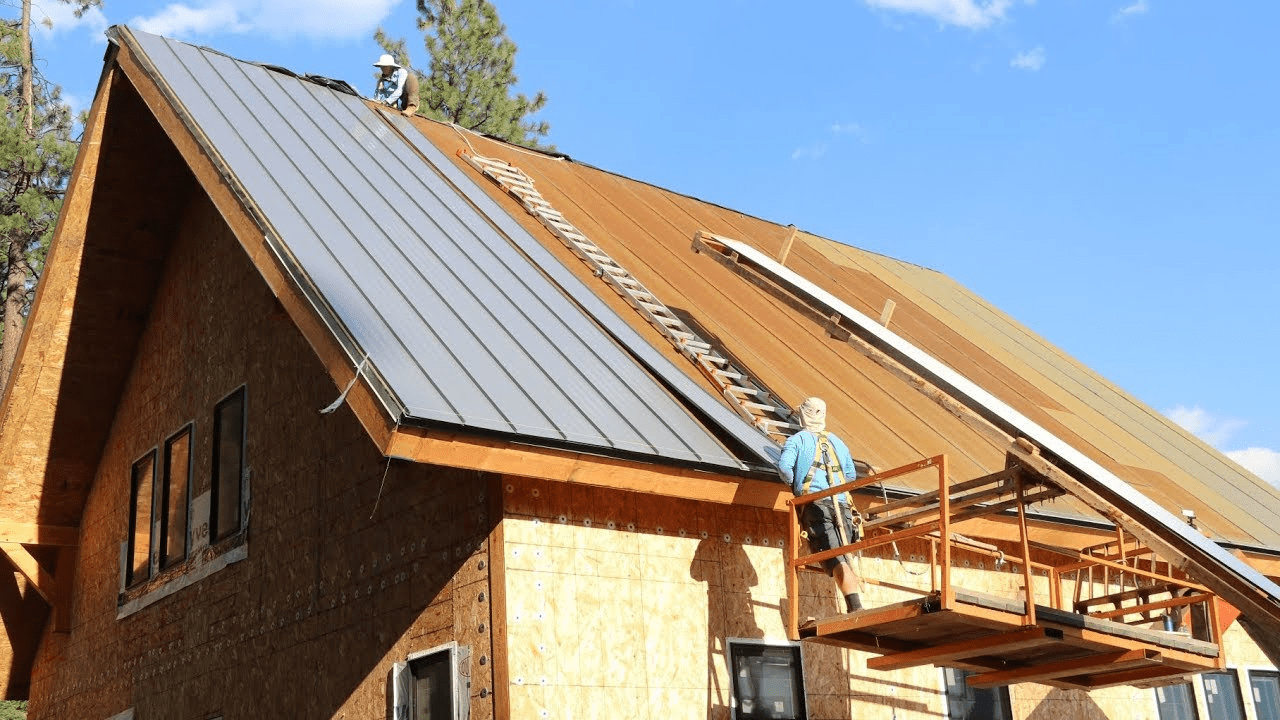

Metal roofs are an increasingly popular choice among homeowners due to their durability, longevity, and aesthetic appeal. Made from materials such as steel, aluminum, copper, or zinc, metal roofs are known for their ability to withstand extreme weather conditions, resist fire, and require minimal maintenance. They come in various styles, including standing seam, metal shingles, and metal tiles, making them a versatile option for different architectural designs.

The Appeal of Metal Roofs

Durability and Longevity

One of the most significant advantages of metal roofs is their durability. Unlike traditional asphalt shingles, metal roofs can last 50 years or more with proper maintenance. They are resistant to cracking, shrinking, and eroding, making them ideal for harsh weather conditions such as heavy rain, snow, and high winds.

Energy Efficiency

Metal roofs reflect solar radiant heat, which can reduce cooling costs by 10-25% during the summer months. This energy efficiency is not only beneficial for the environment but also helps homeowners save on their energy bills.

Read too: How To Replace A Mobile Home Roof: Step-by-Step Guide for Homeowners

Aesthetic Variety

Available in a wide range of colors, styles, and finishes, metal roofs can enhance the curb appeal of any home. Whether you prefer the traditional look of shingles or the sleek appearance of standing seam panels, there is a metal roofing option to suit your taste.

Fire Resistance

Metal roofs are non-combustible, providing an added layer of protection against fire. This characteristic can be particularly advantageous in areas prone to wildfires.

Do Insurance Companies Cover Metal Roofs?

Standard Homeowners Insurance Policies

Most standard homeowners insurance policies cover roof damage caused by perils such as fire, windstorms, hail, and falling objects. However, the extent of coverage can vary depending on the insurance company and the specific policy terms.

Comprehensive Coverage

In many cases, insurance companies offer comprehensive coverage that includes damage to metal roofs. This coverage typically extends to both the repair and replacement of the roof if it is damaged by a covered peril. However, it is essential to read your policy carefully and understand any exclusions or limitations that may apply.

Factors Influencing Coverage

Several factors can influence whether and how insurance companies cover metal roofs:

- Age of the Roof: Newer metal roofs are more likely to be fully covered than older ones. Insurance companies may depreciate the value of an older roof, leading to lower reimbursement amounts.

- Roof Condition: The overall condition of the roof at the time of the claim can impact coverage. Well-maintained roofs are more likely to receive favorable consideration.

- Geographic Location: The location of your home can affect coverage. For instance, homes in areas prone to hailstorms may have specific provisions regarding roof coverage.

- Type of Metal Roofing: Different types of metal roofing materials may be treated differently by insurance companies. It is essential to check how your specific metal roof type is covered.

Benefits of Insuring a Metal Roof

Insuring a metal roof can offer several benefits, including:

- Peace of Mind: Knowing that your investment in a durable metal roof is protected can provide peace of mind.

- Financial Protection: Insurance coverage can help mitigate the financial impact of unexpected roof damage.

- Potential Discounts: Some insurance companies offer discounts for homes with metal roofs due to their durability and resistance to damage.

Steps to Ensure Your Metal Roof is Covered

Review Your Policy

Carefully review your current homeowners insurance policy to understand the extent of coverage for your metal roof. Look for specific mentions of metal roofing and any exclusions that may apply.

Talk to Your Insurance Agent

Discuss your coverage needs with your insurance agent. They can provide detailed information about your policy, suggest additional coverage options if needed, and help you understand any potential limitations.

Consider Additional Coverage

If your current policy does not adequately cover your metal roof, consider purchasing additional coverage. This might include an endorsement or rider specifically for roof damage or a separate roof insurance policy.

Document Your Roof’s Condition

Maintain thorough documentation of your roof’s condition, including photographs and records of maintenance and repairs. This documentation can be invaluable when filing a claim, as it provides evidence of the roof’s state before any damage occurred.

Regular Maintenance

Regular maintenance is crucial to prolonging the life of your metal roof and ensuring it remains in good condition. This can include cleaning debris, inspecting for damage, and promptly addressing any issues that arise.

Common Issues and How to Address Them

Leaks and Water Damage

While metal roofs are highly durable, they can develop leaks over time, especially around seams, flashing, and fasteners. Regular inspections can help identify potential issues early. If a leak occurs, it is essential to address it promptly to prevent water damage to your home’s interior.

Hail Damage

Hail can cause dents and other damage to metal roofs. If you live in an area prone to hailstorms, consider choosing a metal roofing material designed to withstand hail impact. After a hailstorm, inspect your roof for damage and file a claim with your insurance company if necessary.

Corrosion and Rust

Some types of metal roofs, particularly those made from steel, can be susceptible to corrosion and rust. Protective coatings and regular maintenance can help prevent these issues. If corrosion or rust is detected, it should be addressed immediately to avoid further damage.

Expansion and Contraction

Metal roofs can expand and contract with temperature changes, which can cause fasteners to loosen over time. Regularly check and tighten fasteners as needed to maintain the roof’s integrity.

Conclusion

So, do insurance companies cover metal roofs? The answer is generally yes, but it depends on the specifics of your policy and the condition of your roof. Metal roofs offer numerous benefits, including durability, energy efficiency, and aesthetic appeal, making them a worthwhile investment for many homeowners. To ensure your metal roof is adequately covered, review your insurance policy, discuss your coverage with your agent, and consider additional coverage if necessary. By taking these steps, you can enjoy the peace of mind that comes with knowing your home is protected.

Leave a Reply