Replacing your roof can be a significant financial investment. Many homeowners wonder if they can recoup some of this expense through tax deductions. This article explores the question, “Can I deduct my roof replacement?” and provides valuable insights into the circumstances under which you might be eligible for tax benefits.

Understanding Roof Replacement Costs

Why Roof Replacement is a Major Expense

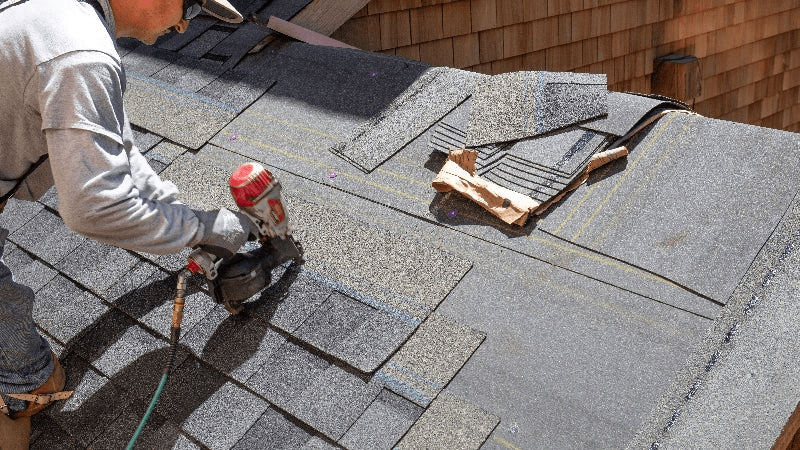

Roof replacement is one of the most substantial home improvement projects. The cost typically includes:

- Materials: Shingles, underlayment, flashing, and more.

- Labor: Installation, removal of old roofing, and disposal of debris.

- Additional Costs: Potential repairs to underlying structures, permits, and inspections.

Given the high cost, homeowners are understandably interested in any financial relief that might be available, including potential tax deductions.

Read too: How To Replace Roof Shingles That Blew Off: A Comprehensive Guide

Can I Deduct My Roof Replacement?

General Tax Deduction Rules for Home Improvements

Home improvements, including roof replacement, can sometimes qualify for tax deductions or credits. However, the specifics depend on various factors. Here’s a breakdown of the primary scenarios:

- Personal Residence: Generally, repairs and maintenance to a personal residence are not deductible. However, major improvements that increase the value or extend the life of your home, like a new roof, may have different implications.

- Rental Property: If the property is an investment or rental property, the cost of a new roof may be deductible as a business expense. This is because the roof replacement is considered a necessary expense to maintain the property’s value and function.

- Energy Efficiency Improvements: If your roof replacement includes energy-efficient upgrades, such as reflective coatings or better insulation, you might be eligible for certain tax credits.

Specific Situations Where Roof Replacement May Be Deductible

Roof Replacement on Rental Property

For rental properties, the IRS generally allows property owners to deduct the cost of repairs and maintenance. Roof replacement, if it is part of maintaining the property’s value and not a capital improvement, might be deductible. It’s essential to categorize the expense correctly:

- Repairs: Routine maintenance or repairs that do not significantly increase the property’s value may be deductible in the year the expense is incurred.

- Capital Improvements: Roof replacements that significantly enhance the property’s value or extend its life are considered capital improvements. These costs must be depreciated over time rather than deducted in the year they are incurred.

Roof Replacement with Energy-Efficient Upgrades

If your roof replacement includes energy-efficient components, such as cool roofs or improved insulation, you may qualify for specific tax credits:

- Residential Energy Efficient Property Credit: This federal tax credit allows homeowners to claim a percentage of the cost of qualifying energy-efficient upgrades. Check current eligibility criteria and credit percentages, as they can change annually.

Roof Replacement Due to a Natural Disaster

If your roof replacement is due to damage from a natural disaster, you may be able to claim a casualty loss deduction:

- Casualty Loss Deduction: If your home suffered damage due to a natural disaster and you had to replace the roof, you might be able to deduct the loss on your tax return. The amount of the deduction depends on the extent of the damage and insurance reimbursements.

How to Determine Deductibility

Documenting Your Roof Replacement

To support your claim, keep thorough records of your roof replacement project:

- Invoices and Receipts: Maintain all receipts and invoices related to the cost of the roof replacement, including materials and labor.

- Before and After Photos: Photos of the roof before and after the replacement can provide evidence of the extent of the work done.

- Insurance Claims: If the replacement was covered by insurance, keep a record of the insurance claim and any reimbursements received.

Consulting with a Tax Professional

Tax laws and regulations are complex and subject to change. To ensure you’re maximizing any potential deductions or credits:

- Consult a Tax Advisor: A tax professional can help you navigate the specific details of your situation and provide guidance on how to categorize and report the expense correctly.

- Stay Updated on Tax Laws: Tax credits and deductions can change yearly, so staying informed about current regulations is crucial.

Conclusion

The answer to “Can I deduct my roof replacement?” depends on various factors, including the type of property and the nature of the replacement. While personal residence roof replacements generally do not qualify for immediate deductions, rental properties and energy-efficient upgrades may offer potential benefits. Consulting with a tax professional and maintaining thorough documentation are essential steps to ensure you take advantage of any available tax benefits.

Leave a Reply